EWZ ETF: Worth the Risk Despite Lula’s Intervention (NYSEARCA:EWZ)

Jamesbury

iShares MSCI Brazil (NYSEARCA:EWZ) has been under pressure since my previous ETF article in January, falling nearly 8%. I have previously argued that the EWZ could be entering the next phase of a bull market This started at the Covid lows of 2020 as the index’s bullish breakout and falling US real bond yields caught investors’ attention. However, sentiment was undermined by the government’s decision to replace the CEO of oil giant Petrobras, raising fears of further government intervention in the corporate sector. While I believe Brazilian stocks deserve to trade at a significant discount to their emerging market peers, such a discount would also allow continued outperformance through much higher dividend income. Moreover, rising commodity prices are highly supportive of Brazilian assets and have clearly demonstrated the cracks of bad policy in the past.

EWZ ETF

EWZ tracks the performance of the MSCI Brazil Index and is dominated by financial stocks with a 26% weight in the index. However, the ETFs are widely viewed as a commodity due to their 38% weighting in energy and materials stocks. Oil major Petrobras is the largest stock in the index, with a weight of 18%, followed by iron ore miner Vale, which has a weight of 12%.

One downside is the fund’s high expense ratio of 0.59%, compared to 0.19% for the Franklin FTSE Brazil ETF (FLBR) which tracks the FTSE Brazil Index. Since the two funds have very similar equity weightings, the latter may be preferable to buy and hold investors due to its lower cost, while the more liquid EWZ may be preferable to more active traders. EWZ’s stated dividend is 6.5% versus FLBR’s 10.0%, but this difference appears to reflect different dividend approaches and over time we should see both converge toward their respective index yields of 7.4%.

There is cheap and then there is cheap Brazil

Regardless of the valuation metric used, the MSCI Brazil Index is undeniably cheap. The table below shows how undervalued Brazilian stocks are relative to their long-term average and relative to the MSCI Emerging Markets Index.

| Current format | Discount on medium LT | Rating percentage | Discount on MSCI EM | Relative rating percentage | |

| Price/earnings | 7.7 | 46% | fourteenth | 50% | The tenth |

| Price/Sales | 0.9 | 31% | The tenth | 30% | the first |

| Price/book | 1.4 | 17% | Twenty | 14% | twelveth |

| Value Added/EBITDA | 5.6 | 41% | The tenth | 45% | Fifth |

| Profit return | 7.4% | 38% | Seventh | 63% | Seventh |

| Free cash flow return | 12.1% | 62% | fourteenth | 46% | nineteenth |

| middle | 39% | Thirteenth | 39% | Ninth |

Cheap stock markets on a price-to-book and price-to-sales basis, as is the case with Brazil today, tend to be so because of poor levels of profitability, especially on a cash flow basis. However, in the case of Brazil, currency depreciation can be seen in every measure and in particular the free cash flow yield. The FCF yield of 12.1% dwarfs the emerging markets average and is well above its long-term average.

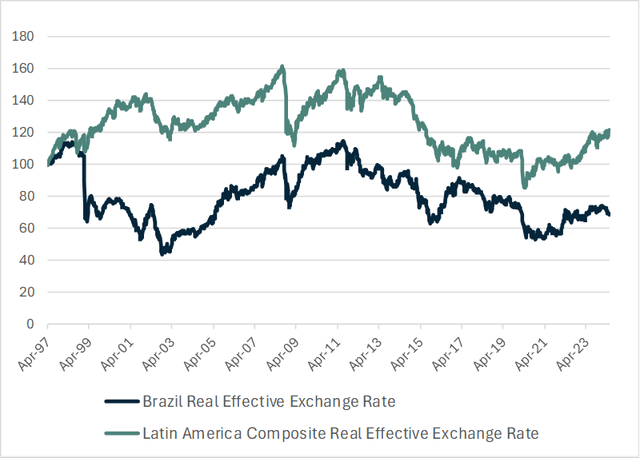

It’s not just the Brazilian stock market that is undervalued compared to its peers. Brazilian TRUE It is also trading at a discount, especially relative to the Latin American forex index, which was driven by the rise of the Mexican peso. This relative depreciation of the currency comes despite the fact that Brazil offers much higher real interest rates compared to its peers, with 10-year Brazilian government bonds now yielding an impressive 6.1%.

City

The discount is justified, but there are also high expected returns

Brazil’s exclusion from its peers appears to be somewhat justified, due to the growing threat of increased government intervention by leftist President Luiz Inacio Lula da Silva. Earlier this month, Lula fired the head of Petrobras over a dispute over what the company should do with its excess profits, as the former CEO wanted to issue an extraordinary dividend and the government believed the profits should be used for reinvestment. In my view, this was the clearest sign since Lula’s return to power last year that the president is prioritizing political goals over the interests of investors. The move also follows a series of developments that show Lula has become increasingly authoritarian in his attempt to marginalize former President Bolsonaro and his supporters under the guise of combating disinformation. Lula’s alliance with foreign dictators like Nicolas Maduro in Venezuela serves as a clear warning to investors about the worst-case scenario facing the country.

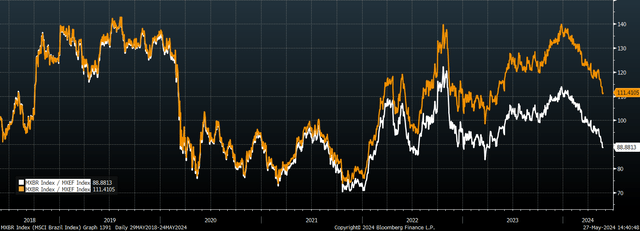

However, when there’s risk, there tends to be reward, and the thing about buying cheap markets is that they don’t need to perform fundamentally well to generate strong returns for shareholders. The high free cash flow yield on the MSCI Brazil Index has resulted in a high dividend yield, which has helped EWZ outperform even with lower valuations. Over the past five years, the MSCI Brazil Index has fallen by more than 10% compared to the MSCI Emerging Markets Index, but in terms of total return it has outperformed by a similar amount.

White: MSCI Brazil / MSCI EM. Orange: MSCI Brazil total return / MSCI EM total return (Bloomberg)

A bull market in commodities would mask policy cracks

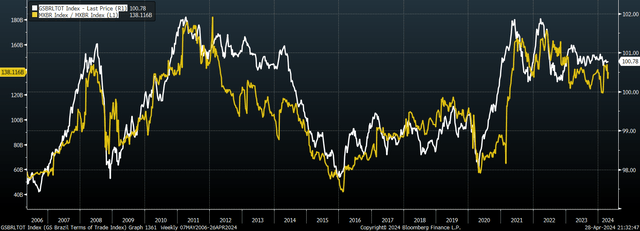

As we saw from the strong performance of Brazilian stocks during Lula’s first presidency in 2003, rising commodity prices can easily hide the cracks left by poor policies. The Brazilian business zone tripled in value compared to the MSCI Emerging Markets Index from 2003 to 2008 as prices for its commodity exports soared, boosting corporate profits and the Brazilian currency. As the chart below shows, the MSCI Brazil Operating Income is closely linked to the country’s terms of trade (the price of its exports relative to its imports).

Brazil’s terms of trade versus MSCI’s operating income in Brazil (Bloomberg, Goldman Sachs)

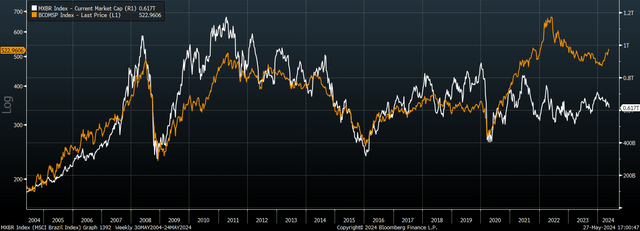

The following chart shows the market capitalization of the MSCI Brazil Index versus the Bloomberg Composite Commodity Index over the past two decades. From 1994 to 2021, the two moved at a steady pace, but over the past three years, falling valuations have led to extremely poor stock performance. Not only is there room for stocks to catch up with rising commodity prices, but there is also a potential breakout in commodities.

MSCI Brazil market capitalization versus commodity prices (Bloomberg)

summary

Brazilian stocks are trading at deeply discounted valuations, which are justified, at least in part, by the policies pursued by Lula’s government. However, even if the valuation discount compared to its peers remains unchanged, the high dividend yield should allow Egyptian War Zone to outperform in the absence of a significant economic deterioration. With recent strength in commodity prices, a major economic downturn seems unlikely, and the EWZ may see a reassessment in its valuations.