Eli Lilly’s Growth and Challenges: Buy Cautiously (NYSE:LLY)

Morsa Images/DigitalVision via Getty Images

Investment thesis

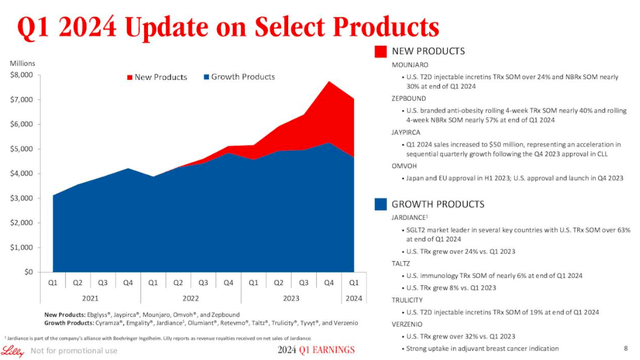

Eli Lilly (New York Stock Exchange: LLY), reported impressive financial results for the first quarter of 2024. Revenue rose 26% year-on-year, supported by strong sales not only of obesity drugs Mounjaro and Zepbound but also of other drugs. Drugs in their portfolio including Verzenio and Jardiance are growing by 40% and 19% respectively. In its latest earnings report, earnings rose to $2.24 billion from $1.34 billion a year earlier, with earnings per share beating expectations to reach $2.58.

View LLY earnings

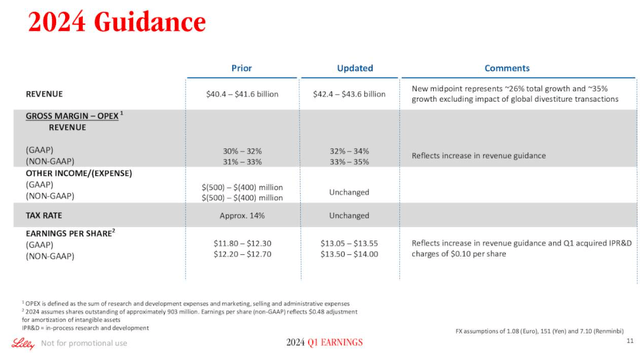

I’m very optimistic about their future and LLY has raised its full-year 2024 revenue guidance to a range of $42.4 billion to $43.6 billion, up from the previous estimate of $40.4 billion to $41.6 billion. Likewise, adjusted EPS guidance rose to $13.50 to $14.00 per share, above the prior range of $12.20 to $12.70 per share.

LLY View earnings

However, I find that Eli Lilly is not without its challenges. The stock price seems to be hitting all-time highs every month, and a deeper look at the company’s financials, company strategy and management is needed to get a better picture of its potential.

The company is also currently facing supply constraints for some of its most sought-after drugs, particularly Mounjaro and Zepbound, both of which are used for the growing demand for anti-obesity drugs. Despite this hurdle, during the earnings call, LLY’s CFO stated that they expect significant increases in shipping volumes by the second half of 2024, thanks to continued investments in expanding manufacturing capacity.

Given the strength we are seeing in our business and expectations of continued acceleration expected in the second half of the year, we are increasing our full-year revenue forecast by $2 billion at the upper and lower ends of the range to $42.4 billion to $42.4 billion. $43.6 billion. This increase was primarily due to the strong performance of Mounjaro and Zepbound and increased visibility and confidence in extending our production into the remainder of 2024.

I aim to find companies that are growing at a reasonable price. I think LLY is a good candidate because I believe its growth will expand in the medium term, and while no specific market share is available for obesity drugs, the high demand and expected growth suggest that LLY can remain a major player in the market. It is expected to reach $100 billion by 2030. For all of these reasons, I would be inclined to initiate coverage of LLY with a cautious buy.

Management evaluation

Dave Rex, CEO of Eli Lilly for more than 7 years, has had a long and accomplished career with the company after joining in 1996. He has experience in marketing, sales, drug development and international operations. Under his leadership, Lilly achieved record results in research, development and business. Additionally, both Rex and Eli Lilly have received positive reviews on Glassdoor, indicating employee satisfaction with the company culture and leadership.

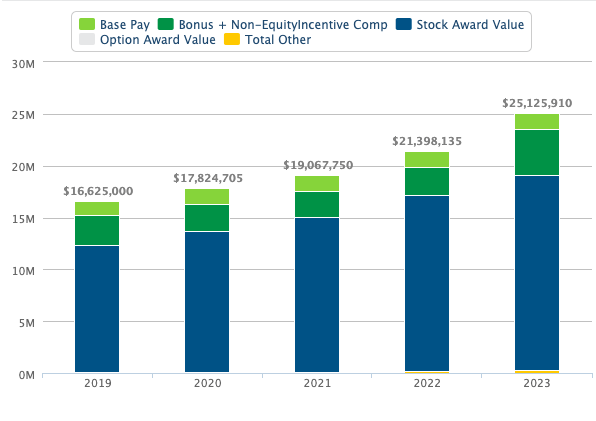

I also find that he has a “high alignment” with the company’s success, with a significant portion of about 75% of his compensation tied to the company’s future success in the form of stock awards.

Salary.com

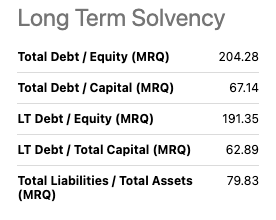

Anat Ashkenazi brings extensive finance experience to Eli Lilly, where she has served in various finance and strategic roles since 2001. Currently, as CFO, she oversees the finances of the R&D, manufacturing, and commercial aspects of the company. Under her leadership, the company began financing a significant capacity expansion beginning in 2023, which increased debt and pushed its debt-to-equity ratio above 200%, especially when the company had zero free cash flow and every dollar spent On interest it becomes expensive. Not available for future growth. Despite the concern, I believe the company has entered a phase where it is benefiting from previous investments and is therefore seeing revenue growth, indicating future returns on investments.

However, with low cash reserves and high debt servicing costs, there is limited room for additional spending. I believe this represents a key opportunity for future success: increasing their cash balance.

Searching for alpha

Finally, Dr. Dan Skovronsky, the company’s chief scientific officer, has a scientific and leadership background. As Vice President of Science and Technology, he heads Lilly Research Laboratories and Lilly Immunology, and serves as a consultant to the company. Before joining Lilly in 2010, he founded and led Avid Radiopharmaceuticals Inc. Throughout his tenure at Lilly, Dr. Skovronsky held several key positions including Chief Medical Officer and oversaw areas such as diabetes research and product development.

Overall, I believe the Eli Lilly team demonstrates a strong commitment to the company’s long-term success. Rick’s leadership and high approval rating were notable in our Glassdoor review results. I believe management is well positioned to overcome current capacity challenges. Their strategic move into the obesity drug market has clearly benefited the company. Considering all these factors, I rate the Eli Lilly team at “Exceeds Expectations.”

This is the first time I have given company management this rating. However, it is important to acknowledge the inherent risks. A company’s debt level and free cash flow issues require careful monitoring to ensure long-term growth is sustainable.

glass door

Cooperative plan

Eli Lilly boasts a competitive advantage thanks to a diverse drug portfolio. While rivals like Pfizer (PFE) are out of the obesity drug race for now, LLY’s advantage is a first mover with Mounjaro and Zepbound for weight management putting them firmly in line. Their diverse portfolio, including an Alzheimer’s drug in late-stage trials, bodes well in a growing market and better positions them for Novo Nordisk’s high adoption in diabetes treatment. Although it is difficult to pinpoint the exact number of successful drugs, LLY’s continued focus on innovation across therapeutic areas positions it well for future growth, compared to companies that are likely to be overly reliant on a single area.

I’ve created the table below to compare LLY’s current strategy with some of its current competitors:

|

Eli Lilly |

Novo Nordisk (NVO) |

Amgen (AMGN) |

Roche (OTCQX:RHHBY) |

|

|

Cooperative plan |

It focuses on innovation in key areas such as diabetes, oncology and immunology. Launching new medicines in key areas including late-stage medicine for Alzheimer’s disease. Expand geographically. Strategic cooperation |

Focus on diabetes and other chronic diseases. Maintain first mover advantage and expand GP1 portfolio. Investing in research and development of new treatments |

Specializes in the development and commercialization of biotechnology medicines. Expansion into new areas. Focus on acquisitions and partnerships. |

Focus on pharmaceuticals and diagnostics, with a strong presence in oncology. Maintain market share in oncology. Investing in personalized medicine. Expansion of gene therapy. |

|

The case of obesity medications |

consent |

consent |

Mid stage |

Early stage |

|

Advantages |

Strong pipeline in a diversified portfolio, positive company sentiment, and first mover advantage. |

First mover advantage in the diabetes market, brand recognition in Europe increasing in the US. |

Strong focus on the biology and history of successful medicines. |

Strong market position in oncology and history of innovation. |

|

cons |

High debt levels. Free cash flow issues. |

Counting on the future success of the diabetes market. Potential generic competition. |

Limited portfolio of small molecule drugs, high R&D costs. |

High drug prices and the possibility of generic competition. |

Source: From the SeekingAlpha presentations website

evaluation

Eli Lilly is currently trading at around $820.34, up about 5% after it reported earnings in late April.

To evaluate its value, I used a conservative discount rate of 11%. This rate reflects the minimum return an investor would expect to receive for their investment. Here, I use a risk-free rate of 5%, plus an additional risk premium for holding stocks versus risk-free investments, and I use 6% for this risk premium. While this could be improved further, either lower or higher, I only use it as a starting point to get a measure of unbiased market expectations.

Then, using a simple 10-year, two-stage DCF model, I inverted the formula to find the high growth rate. To achieve this, I assumed a conservative final growth rate of 4%. In my experience, this rate reflects a slower but more sustainable growth trajectory for mature companies over the long term. Again, this rate can be higher or lower, but from my experience I feel comfortable using a 4% rate. The formula used is:

$820.34 = (Sum^10 FCF(1+”X”) / 1+r)) + TV (Sum^10 FCF(1+g) / (1+r))

Solve for g = 34.5%

This indicates that the market is currently pricing LLY FCF to grow at a rate of 34.5%. However, according to Seeking Alpha analyst consensus, FCF is expected to grow by 38.56%.

Searching for alpha

So, I think Eli Lilly is a little undervalued at this point as the market is pricing in only 34.5% growth in FCF. I also have confidence in management’s ability to execute on its expansion strategy and maintain a first-mover advantage despite current supply chain challenges.

Technical Analysis

LLY has been on a tear, with its stock price hitting all-time highs recently and closing the week at around $820. However, the one-year chart reveals occasional declines between earnings reports, such as those seen in September and October 2023, so its short-term path is difficult to predict.

Despite the short-term volatility, I am cautiously optimistic about LLY’s long-term growth potential. This caution stems from the reality of the pharmaceutical industry: successful drugs often have a short lifespan. New companies can enter the market with a new formulation, and online pharmacies, such as Hims & Hers (HIMS) can bypass the FDA during shortages, taking away market share.

While LLY’s diversified drug portfolio, including a promising late-stage Alzheimer’s disease drug, offers some protection, its heavy focus on GLP-1 may hinder investments in other areas.

Overall, right now, I believe in the medium-term potential, and I’m inclined to rate the stock a buy on any weakness; However, careful monitoring is crucial. The next earnings report is expected to be August 8th.

Tradingview

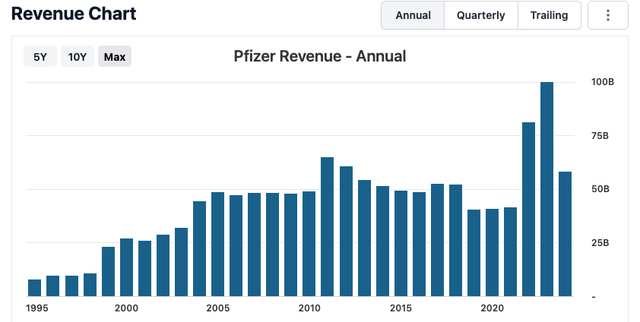

Finally, although the scenario and time are different, the dot-com bubble and Pfizer’s experience serve as a cautionary tale for LLY. After the huge success of Viagra in 1998, Pfizer’s revenue growth eventually slowed, which affected its stock price. New entrants, including a drug from LLY, began competing for market share in 2003.

This emphasizes the importance of considering all the factors that could affect a pharmaceutical company. As new information emerges and the market evolves, I will continually evaluate my investment thesis for LLY.

Inventory Analysis.com

TradingView

Away

Eli Lilly is on the verge of tears, but a closer look is needed. Strong first-quarter results and a diversified portfolio are impressive, but rising equity and debt prices require caution. Management is robust, and obesity medication is a plus. However, free cash flow will likely become a concern in the future. The valuation suggests that LLY is slightly undervalued, but competition and focus on GLP-1 drugs present risks. Overall, I find LLY’s mid-term potential to be good, but careful monitoring is crucial. Given all the factors, I started my coverage of LLY with a cautious buy.