FSMD: A balanced, multi-factor approach, unable to compete in the market (NYSEARCA:FSMD)

porcorex/iStock via Getty Images

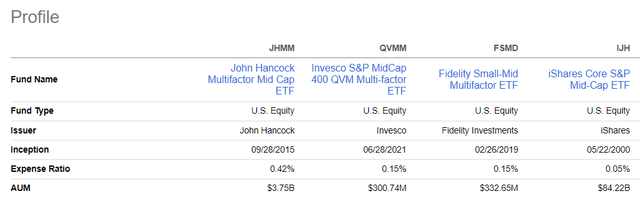

Today I’d like to add another multifactor ETF to my coverage list by reviewing the Fidelity Small-Mid Multifactor ETF (NYSEARCA:FSMD). After dissecting her wallet, I can conclude that she has FSMD A well-balanced multi-factor approach, mostly achieving volume, value, quality, low volatility and momentum, although there are some weaknesses worth addressing, which is what I’m supposed to do today. However, despite the strategy’s intricate calibration, over the course of its 5+ year trading history, the ETF has not been able to consistently outperform the mid-cap stocks represented by the S&P 400, let alone the market. Although I support this vehicle in part because of its meager 15 basis point expense ratio, I believe the Buy rating is not justified.

FSMD Strategy: Integrating four factors into SMID file

According to the FSMD website, the ETF tracks the Fidelity Small-Mid Multifactor Index. From the methodology document available on the Fidelity website, we know that this index

It is designed to reflect the performance of U.S. mid- and small-cap stocks with attractive valuations, high-quality profiles, positive momentum signals, and lower volatility than the broader market.

The selection universe consists of “the top 3,000 U.S. companies, excluding the largest 500 companies, based on float-adjusted market capitalization.” The idea is to pick the 600 most valuable stocks using a composite factor score, but this number may go up or down slightly over time. As explained in the methodology:

To determine each stock’s exposure to its target value, quality, momentum and low volatility factors, a composite score is calculated. The composite score is a weighted average score based on multiple measures of the four factors. Composite scores are calculated separately within each sector. Stocks are selected for inclusion in the index based on their composite factor score.

Performance: Beating a few peers but lagging the market

First, investors who bought into FSMD shortly after its listing in February 2019 are likely to be disappointed by its performance. The fact is that the ETF has lagged not only the iShares Core S&P 500 ETF (IVV) but also the iShares Core S&P Mid-Cap ETF (IJH) which tracks the S&P 400, an issue far more pressing than its inability to hold. Pace with the market.

To reiterate, below is a comparison of FSMD’s total returns and other performance metrics with those of IVV, IJH, and its peer, the John Hancock Multifactor Mid Cap ETF (JHMM). Period: March 2019 – May 2024.

| measurement | FSMD | IVV | IJH | Jhmmm |

| Beginning balance | $10,000 | $10,000 | $10,000 | $10,000 |

| The final balance | $16,424 | $20,667 | $16,947 | $16,852 |

| Compound annual growth rate | 9.91% | 14.83% | 10.57% | 10.45% |

| standard deviation | 20.70% | 18.14% | 21.99% | 20.82% |

| Best year | 25.74% | 28.76% | 24.71% | 24.53% |

| Worst year | -11.52% | -18.16% | -13.10% | -15.30% |

| Maximum withdrawal | -29.26% | -23.93% | -29.70% | -27.45% |

| Specific ratio | 0.46 | 0.74 | 0.47 | 0.48 |

| Sortino ratio | 0.68 | 1.15 | 0.71 | 0.72 |

| Capture upside down | 87.90% | 100.88% | 97.01% | 94.17% |

| Capture the downside | 99.67% | 96.89% | 108.56% | 105.50% |

Data from portfolio visualizer

Here, FSMD’s returns look rather lackluster as it lagged all selected ETFs.

The next period is July 2021-May 2024, shortened because I added another peer, the Invesco S&P MidCap 400 QVM Multi-Factor ETF (QVMM), which launched in June 2021.

| measurement | FSMD | IVV | IJH | QVMM | Jhmmm |

| Beginning balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| The final balance | $11,664 | $12,857 | $11,587 | $11,542 | $11,109 |

| Compound annual growth rate | 5.42% | 9.00% | 5.18% | 5.04% | 3.67% |

| standard deviation | 18.95% | 18.13% | 20.74% | 20.67% | 19.88% |

| Best year | 17.39% | 26.32% | 16.42% | 15.42% | 14.52% |

| Worst year | -11.52% | -18.16% | -13.10% | -13.07% | -15.30% |

| Maximum withdrawal | -19.22% | -23.93% | -21.57% | -21.59% | -23.03% |

| Specific ratio | 0.21 | 0.4 | 0.2 | 0.19 | 0.12 |

| Sortino ratio | 0.33 | 0.6 | 0.31 | 0.3 | 0.19 |

| Capture upside down | 86.03% | 103.87% | 95.44% | 90.90% | 93.38% |

| Capture the downside | 91.14% | 96.47% | 101.50% | 102.35% | 99.97% |

Data from portfolio visualizer

Over this time frame, FSMD looks much stronger, with a higher annualized return than its peers and IJH, as well as having the lowest downside capture ratio in the group. However, it still lags behind IVV in terms of CAGR and risk-adjusted returns (Sharpe and Sortino ratios).

The FSMD Factor Story: A healthy dose of value, quality, low volatility, and momentum

As of May 30, FSMD had 590 common shares in its portfolio, the main holding being EMCOR Group (EME), with a weight of 46 basis points. There are two important notes here.

- The Chess Depositary Interest (abbreviated as CDI) was in GQG Partners Inc. (ASX GQG Index) priced in Sydney is also in the basket, accounting for 14 basis points. It is classified as “unit stock”. However, since GQG does not have a US listing (e.g., via ADR), I excluded it from the analysis.

- The data set also shows shares of GCI Liberty Inc. Class A marked with ESCROW. GCI Liberty was acquired by Liberty Broadband (LBRDA) (LBRDK) in 2020, so obviously I ignored it as well.

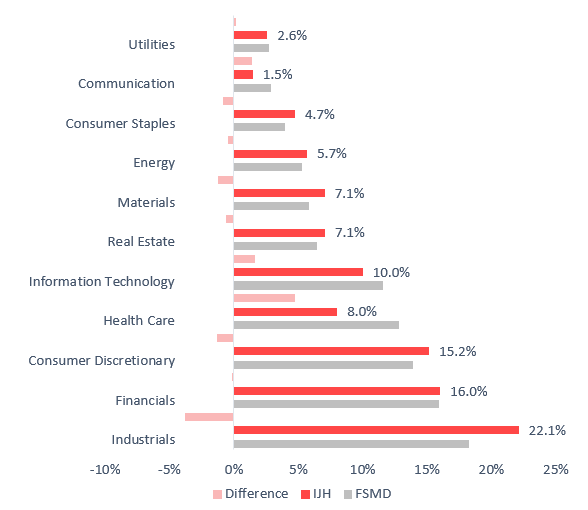

All 11 GICS sectors are represented, with an emphasis on industrials, financials and consumer discretionary sectors. As a reminder, the FSMD’s underlying index adheres to the principle of sector neutrality, so the similarities between the sector choices made by the ETF and IJH do not surprise me.

Created by the author using data from ETFs

Size factor

My calculations show that FSMD has a weighted average market capitalization of $7 billion (as of June 1), which is definitely mid-cap territory. There is healthy exposure to small caps as well, about 12%, and even a footprint in small caps, although microscopic (22 basis points allocated to companies valued at less than $300 million). The FSMD has an allocation of approximately 23.1% to large caps (more than $10 billion in market capitalization), but I think that is enough. For context, the Schwab US Mid-Cap ETF (SCHM) had over 39% of large-cap stocks when I analyzed it in October 2023. And the Franklin US Mid-Cap Multi-Factor ETF (FLQM), which I discussed in April 2024, is at that At the time the weighted average market capitalization was approximately $24.5 billion, and its world of choice was the culprit.

evaluation

FSMD is not supposed to represent the cheapest SMID names. Instead, it’s about balancing the factors, where value has its place. So, here we see a fairly inexpensive wallet, but without anything special.

- An adjusted dividend yield of 5.85% is a healthy result for a mostly mid-cap portfolio. The main contributors are the financial sector and the energy sector, which tend to show a lower profitability ratio. Please note that I removed loss-making companies (8% of net assets) from the adjusted EY calculations. For context, IJH’s website shows a PE ratio of 17.81x (which translates to EY of 5.6%).

- A P/S of 3.59x does not immediately indicate a significant devaluation but it is not excessive either. Adjusted for IDEAYA Biosciences (IDYA), which has a P/E of 151.4x, the number drops to 3.4x.

- Its debt-adjusted earnings yield (EBITDA/EV) of 7.3% also appears to be fairly strong. However, I removed the four- and three-digit EV/EBITDA numbers from the calculations (1.3% of net assets), as well as some financial sector stocks, as the ratio is irrelevant for them.

- Finally, approximately 31% of holdings have a Quantitative Rating Score of B- or higher, which is balanced out by approximately 43.7% allocated to those names rated B+ or worse.

Quality

FSMD has consolidated many of the most important capital efficiency stories, and there is much to appreciate when it comes to margins. However, this wallet is not perfect.

- About 75% allocated to companies with a quantitative profitability score of B or higher is an adequate score according to SMID standards. However, there are much stronger mid-cap portfolios, an excellent example of which is the Invesco S&P MidCap Quality ETF (XMHQ), which had more than 87% allocation to these names as of May 31.

- While nearly a quarter of properties have an ROA above 10%, the weighted average figure is not impressive at just 6.9%. The adjusted return on equity is also acceptable at 16.3%.

Low volatility and mOmentum

The FSMD portfolio has a 24-month weighted average beta of 0.99, according to my calculations, which means it’s slightly less volatile than the market. Meanwhile, about 65% of net assets are allocated to companies with a B- Quantum Momentum score or higher.

Is FSMD worth buying at this point?

The FSMD may appeal to investors looking for low-cost, mid-cap-focused instruments that offer slightly more comfortable volatility than the IJH index, which tracks the S&P 400. It is important to note that it has captured less downside than the S&P 400 ETF since its inception. It had a less painful loss than IVV in 2022 (11.52% vs. 18.16%). Moreover, FSMD has a cost advantage over JHMM.

Seeking alpha

However, this is not enough to take a bullish position.