Harris Associates US Large Cap Value Strategy Commentary for Q1 2024

MicroStockHub/iStock via Getty Images

Market environment

US stocks showed strength throughout the first quarter of 2024, supported by excitement surrounding artificial intelligence, encouraging economic data and investor expectations of interest rate cuts from the US Federal Reserve this calendar year. As a result, US market indices reached new highs. In March, the Federal Reserve’s Open Market Committee met and chose to leave interest rates unchanged while continuing to monitor evolving economic data.

Portfolio performance

The portfolio returned 10.31% (“net”) during the reporting period. This compares to the Russell 1000® Value Index, which returned 8.99% for the same period.

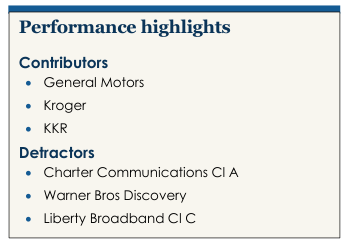

Among the most prominent contributors:

- GM (General Motors) He was a contributor during the quarter. The US-based consumer discretionary company’s stock price rose after fourth-quarter results that were in line with consensus expectations along with 2024 guidance that was ahead of consensus expectations. Despite persistent concerns about an imminent market downturn, demand and pricing have remained resilient. Notably, GM has indicated that its planned investor day will be postponed from March to an indefinite date later in the year as CEO Mary Barra wants to focus on showcasing accomplishments to investors rather than presenting plans in an effort to restore management’s credibility. Overall, we’re pleased with GM’s results because we believe the company remains more resilient than expected. Furthermore, we appreciate the significant cash flow returned to shareholders. General Motors remains an attractive company.

- Kroger (KR) He was a contributor during the quarter. The US-based consumer staples company’s stock price rose after the release of fourth-quarter results that were modestly ahead of consensus expectations and positive guidance for 2024. While the metrics do not look particularly strong, the environment is still returning to normal. After an exceptionally strong performance during Covid-19. Notably, Kroger reiterated its intention to fight the Federal Trade Commission’s lawsuit to block the Albertsons deal. We continue to believe in Kroger’s long-term prospects.

- KKR He was a contributor during the quarter. The US-based financial company’s share price rose after the release of its fourth-quarter results. Notably, private market fundraising, interest income, and capital markets fee generation saw their best results since mid-2022. We modestly increased our intrinsic value estimates following the company’s Q4 results and management’s comments regarding the outlook and look forward to our Investor Day in April. .

Most prominent critics:

- Communications Charter (CHTR) He was one of the biggest critics during the quarter. In February, the US-headquartered telecommunications services company’s stock price fell when the company announced that the number of broadband subscribers fell 0.2% sequentially. We expect broadband subscriber growth to remain a challenge in the near term due to the intense competitive environment and potential reduction in the government support programme. However, we expect these competitive forces to subside in the medium term and for Charter’s broadband subscriber base to return to normal growth. Meanwhile, the company continues to increase its dividend, invest in high-return capital projects and buy back stock. We maintain our belief in the long-term prospects of Charter Communications.

- Warner Bros. Discovery (WBD) It was criticized during the quarter. The US-based telecommunications services company’s share price fell following the release of mixed fourth-quarter results with earnings metrics falling below consensus expectations, mainly driven by the studio segment. On the positive side, free cash flow came in above our expectations, allowing debt repayments to continue, which we were pleased to see. We continue to believe in the long-term prospects of Warner Bros. Discovery.

- Liberty Broadband (LBRDK) It was criticized during the quarter. The US-based telecommunications services company’s stock price fell alongside the release of Charter Communications’ fourth-quarter results due to its investment in Charter. Overall, we think GCI Liberty’s full-year 2023 results were good. Notably, GCI does not expect an impact from the ACP rollout. Instead, the company sees this as an opportunity to gain mobile subscribers. Finally, the number of broadband subscribers rose through 2023. We continue to believe in Liberty Broadband’s long-term prospects.

Determine the position of the wallet

We initiated the following trades during the period:

-

- Delta Airlines (DAL) It is a global airline based in the United States. In our view, the largest US airlines have emerged from the COVID-19 pandemic in the strongest competitive position they have ever held and now capture the vast majority of industry profits. We believe this is a result of growing consumer preference towards premium travel experiences and the response of larger airlines by improving product segmentation. This compares to many low-cost carrier competitors who are in a weak position as they have been disproportionately affected by high cost inflation post-coronavirus. We see Delta Air Lines as the leading and best premium airline brand within the United States thanks to its long track record of industry-leading operational performance and investments in customer experience. We also believe that the company’s ideal geographic positions, high local market share, strong loyalty program, and unique company culture all support good returns on capital. We believe Delta’s current valuation is compelling for a growing, competitively differentiated business.

- Deere & Company (DE) It is a leading agricultural equipment manufacturer with dominant market shares in North America and Brazil. Despite its strong brand, technology capabilities and distribution advantages, the company’s stock price has recently come under pressure due to investor concerns about the downturn in the current agricultural business cycle. In the long term, global population and food demand are expected to increase annually, with less land and labor devoted to agriculture each year. As a technology leader, we believe Deere is well positioned to capitalize on this dynamic as farms will need to become more productive. We also like that the company’s management team has a proven track record of growing the business organically through cycles, continually improving returns on invested capital and returning capital to shareholders. We were able to purchase shares in the company at a discount to our estimates of intrinsic value and other high-quality industrial companies.

- Kinview (KVUE) It became the largest independent consumer health company after its spin-off from Johnson & Johnson in May of 2023. The company’s popular brands, such as Neutrogena, Listerine, Tylenol, and Band-Aid, have been market share leaders in their respective categories for generations. However, Kenvue’s first year as a public company was filled with lawsuits and market share losses in certain categories. Kenvue is trading at a significant discount to the market and other consumer health and packaged goods companies. Furthermore, we see an opportunity for Kenvue to operate more efficiently as an independent entity and reinvest cost savings into increased product development and marketing, which will help improve growth and ensure its brands remain at the forefront of their categories. We believe the market reflects an overly pessimistic view and were recently able to purchase shares at an attractive price of a leading consumer company.

We have removed Amazon (AMZN), HCA Healthcare (HCA), Hilton Worldwide (HLT), Meta Platforms (META), and PHINIA (PHIN) from the portfolio.

Prospects

While we monitor the macroeconomic environment, we continue to focus on our bottom-up fundamental analysis at the company level when constructing portfolios. We invest in companies that are priced at significant discounts to our estimates of intrinsic value, which we believe will grow per share value over time, and we have management teams that think and act like owners. Our analysts are industry-agnostic professionals focused on creating value, regardless of what is preferable at any given moment. We believe this positions our portfolios for long-term sustainable success.

|

The securities identified and described in this report do not represent all securities purchased, sold or recommended to advisory clients. There is no guarantee that any securities discussed here will remain in the account’s portfolio at the time it receives this report or that the securities sold will not be repurchased. It should not be assumed that any of the securities, transactions or properties discussed herein have been or will prove profitable. The information, data, analysis, and opinions presented herein (including current investment topics, portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and opinions of the portfolio managers and Harris Associates LP as of the date written and are subject to change without notice. This content is not a recommendation or an offer to buy or sell a security and no guarantee is made of its veracity, completeness or accuracy. Data are in US dollars unless otherwise indicated. Certain comments contained herein are based on current expectations and are considered “forward-looking statements.” These forward-looking statements reflect assumptions and analyzes made by the portfolio managers and Harris Associates LP based on their experience and perception of historical trends, current conditions, expected future developments and other factors they believe to be relevant. Actual future results are subject to a number of investment and other risks and may differ from expectations. Readers are cautioned not to place undue reliance on forward-looking statements. The Russell 1000® Value Index measures the performance of the large-cap value sector in the universe of US stocks. They include Russell 1000® companies that have lower price-to-book ratios and lower expected growth values. This index is unmanaged and investors cannot invest directly in this index. ©2024 Harris Associates LP All rights reserved. |

Original post

Editor’s note: The summary points for this article were selected by Seeking Alpha editors.