These REITs are better than real estate income

Richard Drury

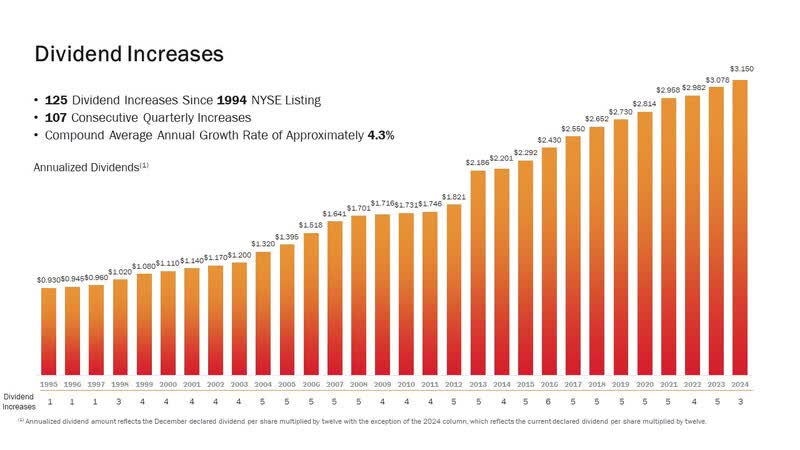

Realty Income (O) is one of the most popular REITs in the world, and it’s easy to understand why.

The company has been able to pay increasing monthly dividends for 30 years in a row. Not even the dot-com crash, A major financial crisis, or an epidemic, could halt its earnings growth.

Real estate income

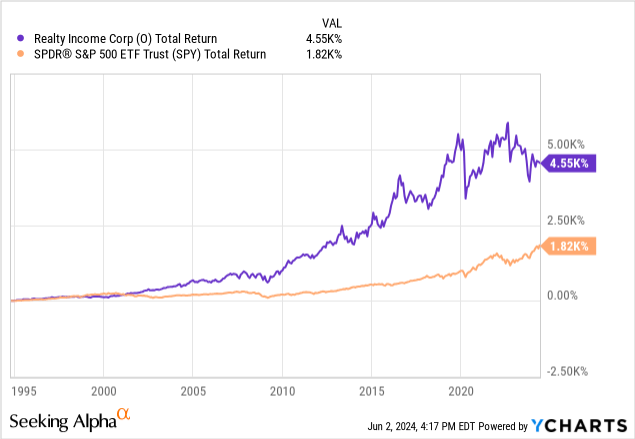

This is not just an income stock. Realty Income also significantly outperformed the rest of the stock market (SPY), providing superior total returns to its shareholders:

Today, the company is larger and better diversified than ever, and has an A-rated balance sheet, however, it is priced at a historically low valuation, offering a dividend yield of approximately 6%.

So, it may seem like a no-brainer for most investors, and I agree that it is a good idea for some investors to invest in a REIT. It is considered.

However, it’s not my favorite.

There are many companies in its peer group that have very similar business models that I expect will deliver much better returns in the future.

Here are 3 of the best from Realty Income:

I agree Realty (ADC)

I have explained in previous articles that Realty Income has two main issues:

#1 – Economies of scale

First, it has become too big for its own good, and its sheer size is likely to hurt its future growth prospects. Net rental REITs grow mostly by acquiring new properties, so the larger you get, the more properties you have to acquire to grow your bottom line. After a certain point, this becomes a problem, as there are only a few new assets for sale at any given time.

Agree Realty, on the other hand, is large enough to be well diversified, and not so large that it hurts its growth prospects:

| Adc | Hey | |

| Market value | 6 billion dollars | 46 billion dollars |

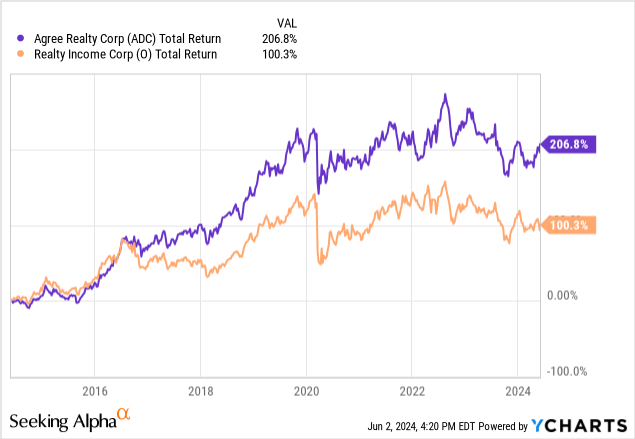

I think this is the main reason why Agree Realty has been so much more useful than Realty Income over the past decade. It uses less leverage and holds higher quality assets, but its smaller size has allowed it to grow faster and has led to much higher returns and I don’t see this changing any time soon:

#2 – Deteriorating portfolio quality

The second issue for Realty Income is that its sheer size is now forcing it to step outside its circle of jurisdiction to expand its acquisition pipeline.

Initially, Realty Income will focus mostly on high-quality net lease properties, often occupied by investment-grade tenants, but has had to expand into other segments of the net lease markets to find sufficient acquisition opportunities, and as a result, we believe that the quality of Her wallet.

Comparing it to Agree Realty, Agree Realty has safer assets, despite being a more advantageous REIT:

| Real estate income | Agree on real estate | |

| Investment grade tenants | ~35% | ~70% |

| Ground rents as part of the portfolio | ~1% | 12% |

| The largest tenant | Walgreens (WBA) (more serious) | Walmart (WMT) (Safer) |

| Cost of equity | ~7.5% | ~6.5% |

| Spreads on new investments | ~50-100 bp | ~100-150 bp |

| Recent insider purchases | Worth $1.7 million Actions In 2023 | Worth $7.1 million Purchases In 2023 |

| Debt maturities in the next five years (until 2028) | Nearly $10 billion | Only $108 million |

| Payout ratio | 77% | 72% |

| The expected internal growth rate in the coming years | ~2% | ~3% |

Agree Realty also has lower leverage and shorter debt maturities in the coming years, as you can see in the table above.

In short, Agree Realty is growing faster, has better assets, has a stronger balance sheet, and is less affected by rises in interest rates, despite this, its valuation is fairly similar to Realty Income’s.

If you adjust for the superior quality of its assets (lower cap rates) and its better balance sheet, its valuation multiples aren’t much different.

| Adc | Hey | |

| Multiple FFO | 14.8x | 13x |

Therefore, I expect Agree Realty to deliver higher total returns with lower risk than Realty Income in the future.

Properties of VISI (VISI)

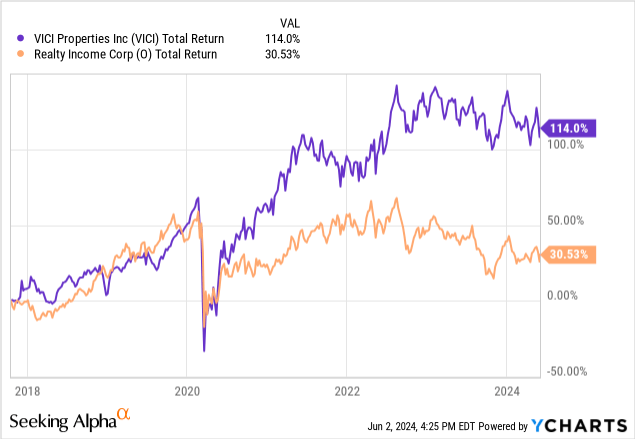

VICI Properties is the largest net-lease REIT focused on casino properties, with a very good track record, easily beating Realty Income since going public:

However, today it shares the same issue size as Realty Income.

They have become huge, and this will likely slow their growth in the future:

| Visi | Hey | |

| Market value | 30 billion dollars | 46 billion dollars |

But VICI has three advantages over Realty Income:

- First, its leases have CPI-based rent escalation, which should lead to faster organic rent growth over the long term. This makes it less dependent on new property acquisitions to continue growth.

- Second, its leases are stronger in that they have longer terms, are true triple net, and tenants are contractually obligated to reinvest millions in their assets each year to keep them desirable. Therefore, you are likely to see less leakage from lease expirations over time.

- Finally, VICI focuses on casinos, which are big ticket investments. A single property can be worth billions, therefore, I would argue that its size is not a big issue. You don’t need to buy hundreds of properties like Realty Income just to keep the ball rolling.

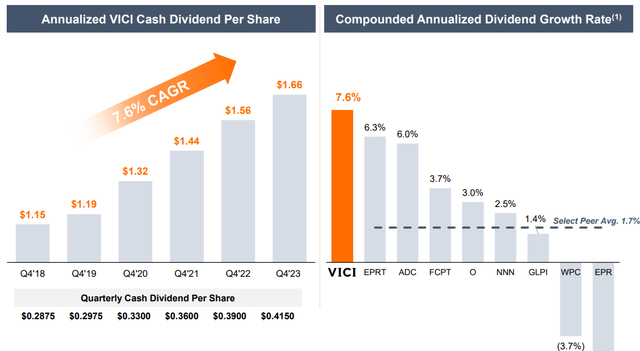

VICI’s growth has been much faster in previous years and I expect this to continue in the long term:

Visi properties

Despite growing at a faster pace, VICI is priced at a similar valuation and yield, and therefore I expect its outperformance to continue moving forward.

You could make the argument that VICI is a little riskier than O and I agree with that. However, note that VICI continued to grow faster than O even during the pandemic, which was the worst possible crisis for the casino rental network REIT. VICI actually enjoyed a higher rent collection rate during the crisis than Realty Income, which really shows you that their properties are mission critical for their tenants. They can’t default on their leases and move elsewhere, because the casino licenses are tied to the property.

So, I think the risk to reward ratio is higher again here.

Essential Properties Realty Trust (EPRT)

Finally, I saved the best for last.

EPRT is a unique REIT that focuses on small middle market companies rather than big-name national chains, and this comes with several advantages.

There is much less competition for these assets. Usually, there is not even a market for them and EPRT needs to find its own off-market transactions through sale and leaseback directly with property operators.

This allows EPRT to structure leases that result in stronger returns with less risk.

Higher returns come from:

- Higher cap rates

- Rents are escalating faster

- Reduced owner responsibilities

Reduced risk is the result of:

- Reaching profitability at the unit level

- Master lease protection

- Corporate guarantees

- Purchase for less than replacement cost

Essentially, EPRT makes up for what it lacks in the credit quality of its tenants by structuring stronger leases and focusing on unit-level profitability of individual assets.

This model was tested with the pandemic, and proved that its strategy was not only more beneficial, but perhaps safer as the company continued to grow faster than its peers during the crisis.

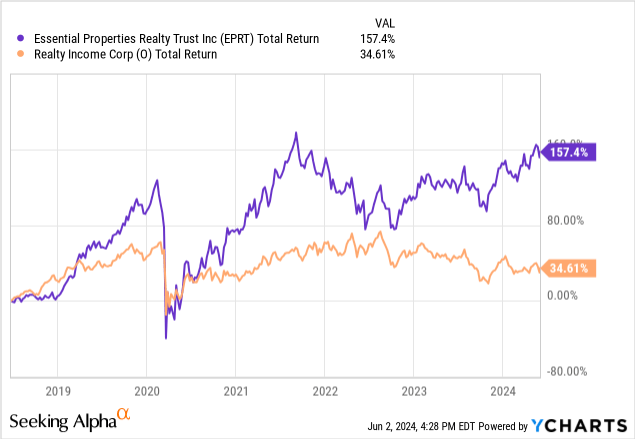

Here are its results versus Realty Income since going public:

This is a very large gap in performance, and is a direct result of EPRT’s superior business model and smaller size, which results in faster growth.

I would add that EPRT has less leverage than Realty Income, so that’s not a reason for its outperformance.

Will this outperformance end anytime soon?

I don’t see the reason for that. Today, EPRT enjoys faster lease escalation and achieves stronger spreads on its new investments. Therefore, its growth will likely continue to outpace Realty Income’s growth, resulting in higher total returns over the long term.

So my take is that EPRT is a little riskier than Realty Income, but its returns are much stronger, and therefore, it offers investors a better risk-to-reward ratio.

Concluding note

The net lease REIT market is broad and versatile, with many companies taking different approaches.

Realty Income is the biggest and most popular, but not the best in my opinion. There are better options and these three companies are good examples of that.