Airbnb: Growth Potential Despite Potential Overvaluation, Cautious Buying (NASDAQ:ABNB)

Thomas Barwick

Investment thesis

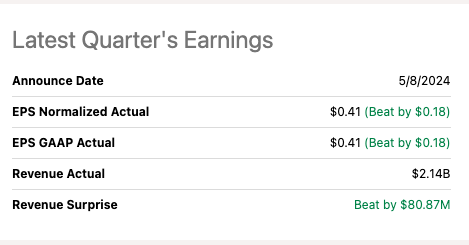

Airbnb (Nasdaq: ABNB) reported strong quarterly results for the first quarter of 2024, beating expectations on both revenue and earnings per share. Net income more than doubled to $264 million, driven by an 18% rise in revenue to $2.14 billion. Nights Booked experiences also grew 9.5% year-on-year to $132.6 million, indicating continued strong demand for travel.

Seeking alpha

Despite the positive results, Airbnb’s forecast for the second quarter was lower than Wall Street’s expectations. Revenues are expected to range between $2.68 billion and $2.74 billion, which is lower than analysts’ expectations due to unfavorable exchange rates. This news caused Airbnb’s stock price to drop nearly 7% following the report.

Below is an analysis of the company’s recent earnings performance:

- Financials: Revenues up 18%, net income up 126%, and adjusted EBITDA up 62% year over year

- Growth: nights and Experiences booked increased 9.5%, total booking value increased 12%, and total nights booked in non-metropolitan areas increased 10%

- Profitability: Adjusted EBITDA margin rose to 20% in the first quarter, with a full-year target of at least 35%.

- Challenges: Lower-than-expected Q2 revenue guidance due to currency and Easter timing.

As an investor looking for companies with reasonable growth, Airbnb presents an interesting case. The company is seeing strong growth in key metrics such as reservations and nights booked. However, the recent decline in stock prices and weaker-than-expected revenue forecasts for the second quarter raise some concerns.

Ellie Mertz, Airbnb’s chief financial officer, participated in Bernstein’s strategic decision conference at the end of May. At this conference, they discussed Airbnb’s growth strategy including market expansion and user base growth, service improvements to simplify booking tools and communications, and building a strong host community.

I believe Airbnb’s core growth strategy remains sound and recent guidance highlights the potential impact of external factors on the economy such as foreign exchange due to rising US interest rates.

While Airbnb’s first-quarter results were positive, its guidance for the second quarter was lower due to currency fluctuations. This underscores the importance of monitoring travel requests and currency impacts on their ability to achieve full-year goals.

I aim to find companies that are growing at a reasonable price, and as you’ll read later, I find ABNB to be slightly overvalued; However, I believe in ABNB’s long-term potential. Their strong fundamental strategy positions them for growth, and management experience inspires confidence. As the economic climate stabilizes, I expect them to achieve higher growth rates. Therefore, I initiate coverage with a cautious buy.

Management evaluation

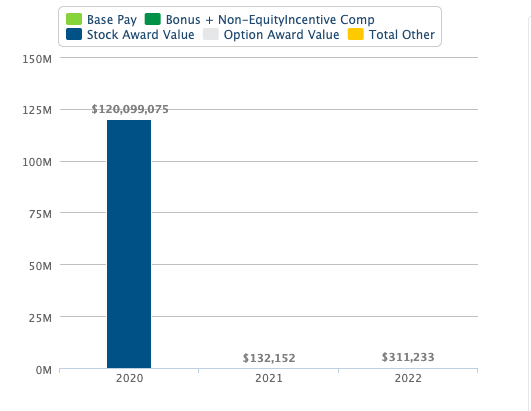

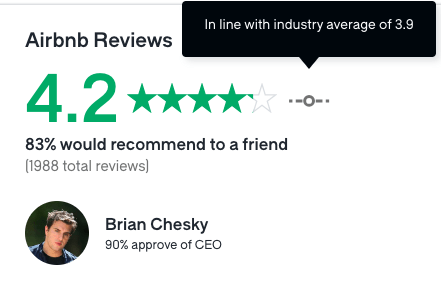

Brian Chesky, co-founder and CEO of Airbnb, is the brains behind the company’s vision and strategy. His leadership has not only translated into strong financial performance for Airbnb, but has also generated positive sentiment at Airbnb based on Glassdoor reviews. The company itself also boasts industry-leading employee satisfaction ratings. One interesting aspect of Chesky’s compensation package lies in a large stock grant awarded in 2020. This grant, valued at $1 billion over 10 years, ties his financial success directly to Airbnb’s long-term growth. This “high consistency” ratio is a clear sign of Chesky’s commitment to building a sustainable and successful company.

Salary.com

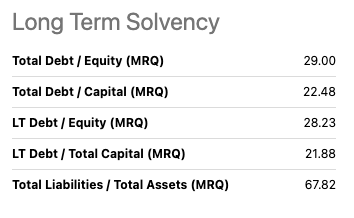

Eli Mertz, an Airbnb veteran who spent eleven years with the company, has been promoted to chief financial officer (CFO). She takes over the reins from Dave Stevenson, who is moving into a newly created role as Chief Business Officer responsible for driving growth for Airbnb. Mertz’s extensive experience stands her in good stead; However, Stevenson’s legacy represents a major challenge to follow. During his tenure as CFO, Stephenson oversaw a period of impressive financial growth for Airbnb, characterized by declining debt levels and continued growth in return on equity. Mertz will benefit from her deep understanding of the company as it strives to maintain this strong financial performance.

Seeking alpha

Overall, Airbnb’s leadership is undergoing a transformation. CFO Dave Stevenson moves into the role of Chief Business Officer, with a focus on growth with his experience. Mertz, who is 11 years old, has been promoted to CFO. While she inherits a strong legacy of continued growth, I am confident in Stevenson’s guidance in his new role. Given this and his continued influence, I give Airbnb management a “meet expectations” until they prove they can navigate the current economic cycle.

glass door

Cooperative plan

Airbnb’s growth strategy is a multi-layered approach. They target new users in developing regions with increasing Internet access and the middle class, with the goal of converting existing users into hosts and expanding their property listings. To improve user experience, build trust and drive growth, they are constantly working to simplify booking and communication. As the new CFO stated during the earnings call, they are “working to improve the overall guest flow of our core business” to drive growth:

We’ve made improvements to the filters. We’ve made improvements to the search input and search box, making the search box more prominent. So, there are dozens and dozens of improvements that we’ve made. And I see hundreds of basis points of incremental growth just by improving overall guest flow for our core business.

Looking beyond rentals, Airbnb is venturing into experiences and catering to group travel. Essentially, they foster a strong host community by simplifying the hosting process and offering tools to help hosts succeed. This not only benefits hosts, but also keeps the platform attractive with a wide range of listings for guests.

I created a table comparing Airbnb’s current strategy with some of its current competitors in a previous article here, and I also update it here:

|

Expedia (EXPE) |

Booking Holdings (BKNG) |

Airbnb |

Trip.com (TCOM) |

|

|

Market share (accommodation bookings) |

15% |

27% |

13% |

10% |

|

Cooperative plan |

Focuses on bundled travel packages and brand diversification. |

Strong global expansion and marketing, with a focus on maximizing hotel partnerships and becoming a one-stop shop for all travel needs. |

Changing traditional hospitality with unique stays and expanding experiences |

Focused on the Asia Pacific market, strong mobile presence, and expanding vacation rentals. |

|

Competitive advantage |

Extensive network of travel suppliers, brand recognition and loyalty program (OneKey) |

Largest online accommodation marketplace, strong mobile presence, and effective marketing. Strong financials. |

Unique accommodation options and a growing experiences market. Strong financials. |

Strong brand recognition in Asia, competitive pricing, and focus on mobile users. |

Source: From the companies’ website, presentations, Seeking alpha

Market Share: Statista (2023)

Compared to competitors like Booking and Vrbo, Airbnb focuses on individual and unique listings, fostering a sense of community and local experiences. Booking offers a wider range of traditional hotel options than professional property listing managers, and Vrbo has a smaller user base and recently underwent a platform migration. While the three platforms compete on user experience, pricing, and trust-building measures, Airbnb’s focus on unique experiences and disruption positions it well for specific segments of travelers, and will likely face less competition from hotels for short stays.

evaluation

Airbnb is currently trading at around $146.66, down about -7% since its last reported earnings on May 8.

To evaluate its value, I used a discount rate of 11%. This rate reflects the minimum return an investor would expect to receive for his or her investment. Here, I use a risk-free rate of 5%, plus an additional risk premium for holding stocks versus risk-free investments, and I use 6% for this risk premium. While this could be improved further, either lower or higher, I only use it as a starting point to get a measure of unbiased market expectations.

Then, using a simple 10-year, two-stage DCF model, I inverted the formula to find the high growth rate, which is the growth in the first stage.

To achieve this, I assumed a final growth rate of 4% in the second stage. Predicting growth beyond a 10-year horizon is challenging, but in my experience, the 4% rate reflects a more sustainable long-term path for mature companies that should be close to historical GDP growth. Again, these assumptions could be higher or lower, but from my experience I feel comfortable using a 4% rate as the base case scenario. The formula used is:

$146.66 = (Sum^10 FCF (1 + “X”) / 1+r)) + TV (Sum^10 FCF (1+g) / (1+r))

Solve for g = 14.5%

This suggests that the market is currently pricing ABNB FCF to grow at a rate of 14.5%. According to Seeking Alpha analyst consensus, FCF is expected to grow by 11.43%.

Seeking alpha

Therefore, I believe that despite ABNB’s strong earnings report, the stock may be slightly overvalued. While the recent slowdown in free cash flow growth is a concern, it is likely due to external factors such as foreign currencies and a strengthening US dollar due to rising interest rates rather than a fundamental issue related to the company’s fundamental strategy. If this is the case, and the underlying growth strategy remains on track, free cash flow growth rates should rebound in the future.

Technical Analysis

ABNB stock is down about 10% since its last earnings announcement on May 8th. Its RSI is low at around 45, rebounding from oversold territory and crossing the 14-day moving average of 40 and pointing to continue rising, indicating that the stock may continue to rise in value.

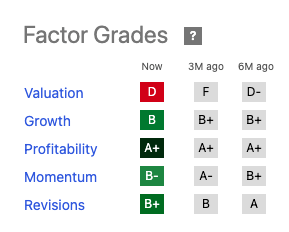

ABNB went public at the end of 2020 and due to the momentum at the time the stock reached an all-time high of $219 in February 2021; However I consider the next resistance level at around $153; This is a 5% move. Momentum according to Seeking Alpha is a bit positive:

Seeking alpha

I think ABNB should still be able to perform well over the long term, which is why I’m cautiously optimistic and rate the stock a Buy where I would consider the stock to be weak. I will revise my investment thesis as needed.

TradingView

The next earnings are expected on August 7.

He stays away

Airbnb’s core strategy of expanding the market, converting users into hosts, and improving service puts them in a good position for growth. Their diversity of experiences and group travel enhance their appeal. While recent guidance has been insufficient due to currency fluctuations, their leadership turnaround combined with the continued influence of former CFO Dave Stevenson inspires confidence. Despite potentially inflated valuations, Airbnb’s sound financials, management, and fundamental strategy make it a cautious buy. The impact of the economic climate and the performance of the new CFO remain factors to watch, but their underlying strategy holds long-term promise.