Costco Earnings: The Only Metric We Need to Measure the Company (NASDAQ:COST)

Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

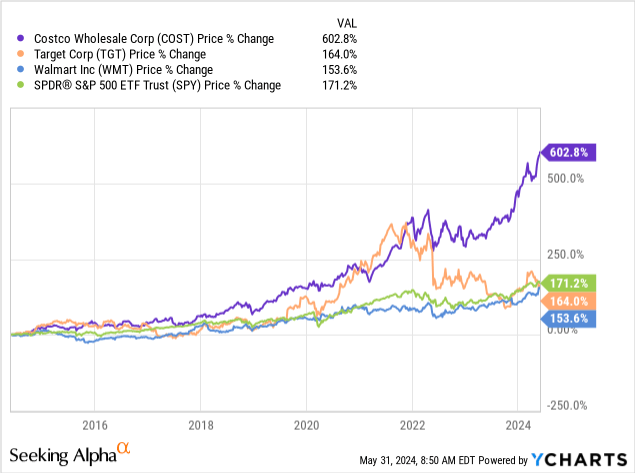

Return to the mean, unexpected sell-offs, dips, temporary weakness. These are all things we know stocks go through from time to time. And then we find a stock that consistently defies gravity without ever becoming hyperbolic. We’re talking about Costco (Nasdaq: Cost). Costco, of course, is Retailer. But once we understand how it runs its business, we discover that it is a unique company with a business model that has become almost irreplaceable.

Costco just released its third quarter earnings report. Here we have another great opportunity to understand the secret behind Costco and say a few words on hot topics like membership fees, its store expansion, and the partnership with Uber (UBER).

Although I’ve often reviewed Costco starting from its business model to presenting and discussing its financial statements, I want to take another approach. today. Starting with its most recent financial statements, we’ll sort of reverse-engineer the company to understand how it operates and understand why it’s been so consistently successful.

Costco profits

Costco’s operating results have once again impressed and delighted investors.

Let’s see what was released:

Costco’s quarterly net sales rose 9.1% to $57.39 billion. In the first three quarters, net sales increased 7% to $171.44 billion. This shows that Costco’s sales are strengthening as we go along. It’s true that there was an estimated 0.5% to 1% positive impact due to the fiscal year turnaround because last year we had a 53rd week. But this proves once again that Costco’s sales have been strong in their own right.

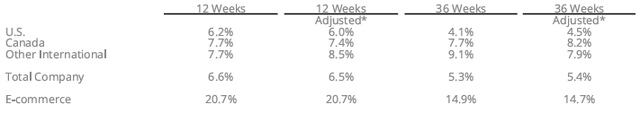

When we deal with retailers, it is not enough to know how net sales have increased. Inflation may be the reason why prices are rising, while volumes are trending down or remaining constant. Therefore, we need to know the comparable sales of the company.

Costco third quarter earnings press release

We see that comparable sales, just like Costco’s revenue, are gaining momentum, with an increase of 6.2% year over year versus 4.1% over the first three quarters. What does this mean? Costco’s growth is mainly due to increased traffic at its warehouses, not just higher prices.

Bottom line, Costco’s net income was $1.68 billion, which equates to $3.78 per diluted share (a year ago Costco reported $1.3 billion and $2.93 per diluted share).

wait a moment! Did we just see only $1.68 billion in net income before revenue of $57.39 billion? That’s a net income margin of 2.9%. How can a company with such low profitability be appreciated by investors?

Costco: The only measure we need

Here we are at Costco’s basic idea, which I described with these words a few months ago:

Costco doesn’t really see itself as a retailer, but rather as a buyer on behalf of its members. These members in turn go to the warehouses to pick up any goods they need among those that Costco has negotiated and purchased. Costco typically marks up its merchandise by 12% to 14%, and sells for almost no profit. Its profits come mainly from membership fees. Therefore, for Costco, declining sales are not as concerning as it is for other retailers because what is holding back the bottom line is the membership program. As long as its members renew their membership, Costco’s bottom line will be insulated from a major economic downturn. As of now, Costco’s replenishment rate is 92.7% in the US and Canada and 90.4% worldwide, as we can read in the recent 2023 annual report.

So, first of all, we have to understand that Costco’s business model is not based on marking up merchandise. Costco essentially sells its goods at full cost (purchase cost plus variable costs and contribution margin). This makes Costco a true top-tier company that needs to increase sales volume higher and higher to reach scale as quickly as possible so that it can create more and more value for its customers. Those who shop at Costco are not customers, but members. To shop there, people must sign up for a membership and pay an annual fee. The relationship works this way: Costco sells select merchandise at a competitive price, and in return its members pay a fee for the right to take advantage of that.

Which brings us to Costco’s second cornerstone, and it’s more important than what we’ve seen so far. Costco’s membership program is constantly expanding and has a consistently high renewal rate.

Now let’s get to the “magic”. We said Costco’s net income was only $1.68 billion. But Costco also reported $1.12 billion in membership fee revenue for the quarter. However, as former Seeking Alpha analyst Benjamin Fund pointed out in his commentary on one of my previous articles on Costco, we must really focus on total membership income to get back to membership income, to understand the true power of the membership program.

What does this mean? Costco offers its executive members a 2% discount on their sales, which we can find listed on the balance sheet as “Accumulated Member Rewards.” When Costco reports its results, its membership fees are actually net of rewards. So let me show you some numbers to illustrate what I take to be taken from the last annual report.

| Paid Members (in Millions) | Membership income (in millions) | Income per member |

| 71 | 4.58 | $65 |

To understand why this is ridiculous, we need to know that Gold Star members at Costco pay $60 per year, while Executive members pay $120 per year. However, at the end of fiscal year 2023, the number of executive members reached 32.3 million and constituted 45.4% of the total membership. Therefore, we should have seen a higher income per member. In fact, executive members paid $3.88 billion in membership fees, while Gold Star members paid $2.32 billion. Total: $6.2 billion. The average income per member should be $87.3.

This means that Costco reports its net membership income, minus its discount for that item.

This shows how Costco is less likely to report net membership income, because for the total membership income, the company gets its discounts.

Costco just revealed that its members’ outstanding bonuses now stand at $2.34 billion. At the end of its most recent fiscal year, Costco reported $2.58 billion and $4.58 billion in membership income. If we add the two numbers together, we get $7.2 billion in potential total membership income. However, this would give us an average income per member of $101, which would be very close to the executive fee.

So, as SA analyst The Benjamin Fund suggested, we could instead net the discount against Costco sales. This helps us visualize something unique.

Let’s use Costco’s last three full fiscal years:

| millions of dollars | 2021 | 2022 | 2023 |

| Reported sales | 192,052 | 222,730 | 237,710 |

| Rewards | 2,047 | 2,307 | 2,576 |

| Net retail sales | 190,005 | 220,423 | 235,134 |

| Merchandise costs | 170,684 | 199,382 |

212,586 |

| Gross profit (net costs of retail and merchandise sales) | 19,321 | 21,041 |

22,548 |

| SG&A | 18,537 | 19,779 |

21,590 |

| Operating profit | 784 | 1,262 |

958 |

Take a look at Costco’s operating profits, which are moving up and down by about $1 billion. This shows that Costco’s dollar revenue is barely profitable.

But, if we discount the discount against total sales, let’s see what comes out in terms of membership income, and compare it to what Costco reports as operating income:

| millions of dollars | 2021 | 2022 | 2023 |

| Membership income as stated | 3,877 | 4,224 | 4,580 |

| + Rewards | 2,047 | 2,307 | 2,576 |

| Total membership income | 5,924 | 6,531 | 7,156 |

| Operating income | 6,708 | 7,793 | 8,114 |

| Membership income as a percentage of OI | 88.3% | 83.8% | 88.2% |

Now, we finally see where Costco makes money: membership fees. And we will make more money from this than we actually think if we don’t do this exercise.

Why is this critical to Costco’s valuation? Because, if the top line doesn’t really matter according to Costco’s profitability, we have a very simplified business model before our eyes that works like this: The more membership increases, the better and better Costco will do. In effect, we can look at Costco this way: store number multiplied by the number of paying members per store multiplied by total membership income.

So, since Costco memberships continue to grow, Costco has no real need to raise its fees as many expect. Yes, we know Costco management always says raising fees is not a matter of if, but when. But we have to understand that Costco doesn’t need that high to cover the loss or anything similar. Whenever a hike comes, the increase will increase Costco’s profits, net of taxes.

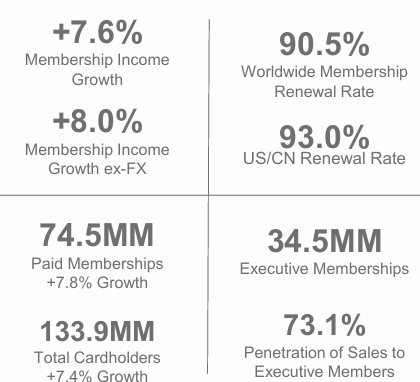

Now that we understand this, we can just read the Costco report and see whether the number of Costco members is increasing or not.

And here we are with the most important numbers contained in the entire report.

Supplemental information on COSTCO Q3 earnings

Yes, Costco’s membership rose 7.8% to 74.5 million, including 34.5 million executive members who account for 73.1% of the company’s sales.

Furthermore, Costco stores increased by 14 units in the United States to 605 warehouses, and in Canada it held steady at 108, while International grew by 2 units to 165.

The total number of stores now stands at 878. As the total stores and members increase, even if the membership fee remains constant, we have very high margin additional revenue. In fact, this revenue goes directly to the bottom line, excluding taxes.

Conclusion

We’ve debated time and time again whether Costco is overvalued or not. Certainly multiples of them require (50 ft. PE). However, investors continue to flock in and pile into stocks, accumulating shares and rarely showing a willingness to part with them. This has created a solid base of loyal shareholders, similar to the same loyalty enjoyed by Costco members. Every now and then, the stock drops a little. However, take a look at what happened the day after the report: The stock was trading just under $820. It then dropped to $790, but then recovered to $810. I know many people are often discouraged by this because they can never get a Costco at the price they set.

Yes, Costco is expensive, but the premium we pay is owning a company that relies on a business model that now, because of its sheer scale and reach, seems almost invincible. In other words, it has a competitive advantage (moat) that sets it apart from others. Few companies I know are as powerful and simple as Costco. So, I started thinking about Costco in another way. We have to make up our minds and decide if this is the stock we want to, so to speak, “marry.” As Bryer, the former SA analyst, says: “It doesn’t matter how much you pay for an engagement ring, if you get married well.” The situation here is similar. Costco has many reasons to continue doubling down and expanding. Those who are willing to stick with this investment for the long term will likely end up doing well and will benefit from those rare and sudden declines in the dollar cost average. Therefore, I rate the stock as a Buy.