Harris Associates Global Strategy Comment for Q1 2024

Andrei Semenov

Market environment

Major global stock markets showed strength throughout the first quarter of 2024. The United States and Europe benefited from excitement surrounding artificial intelligence, encouraging economic data and investor expectations of interest rate cuts from central banks this calendar year. During the quarter, US stock markets reached new highs, and Japanese stocks continued to rise, surpassing a record set 34 years ago. While stocks in China were under pressure throughout 2023, the first quarter of 2024 showed a recovery. In March, the US Federal Reserve, the Bank of England, the European Central Bank and the Bank of Japan held meetings. While the US, UK and Europe chose to leave interest rates unchanged while continuing to monitor evolving economic data, the Bank of Japan issued its first interest rate hike since 2007 and exited negative interest rate territory.

Portfolio performance

The portfolio returned 4.57% (“net”) during the reporting period. This compares to the MSCI World Index, which returned 8.88% for the same period.

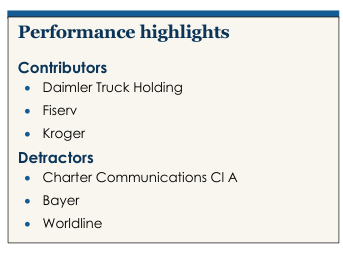

One of the most prominent contributors

- Daimler Truck Holding Company (OTCPK:DTRUY) It was the main contributor during the quarter. In March, the German truck and bus manufacturer released strong fourth-quarter results, accompanied by 2024 margin guidance that significantly beat consensus expectations. The expected margin resilience comes despite the weakness in the global truck market and is a result of management’s decisive actions to improve pricing, increase service penetration and increase cost base flexibility. This is most evident in the Mercedes-Benz segment, which primarily serves European and Latin American markets, which increased its adjusted EBIT margin from less than 1% in 2019 to more than 10% last year. We are impressed by the management’s execution after the separation from the former Daimler Group in 2021 and believe the company is positioned to achieve structurally higher profit margins during the cycle than in the past. We caught up with CEO Martin Daum after the release and we continue to see attractive upside for this investment.

- Fiserv (FI) It was the major contributor during the quarter. The US-headquartered company is a leader in merchant acquisition, issuer processing services and core banking software. During the period we held the stock, Fiserv, under the leadership of CEO Frank Bisignano, achieved industry-leading organic growth, meaningful margin expansion and mid-life earnings per share growth. We believe the company can deliver impressive results in the medium term, yet shares today still trade at a significant discount to the S&P 500. We think Fiserv is performing well and remains an attractive investment.

- Kroger (KR) He was a contributor during the quarter. The US-based consumer staples company’s stock price rose after the release of fourth-quarter results that were modestly ahead of consensus expectations and positive guidance for 2024. While the metrics do not look particularly strong, the environment is still returning to normal. After an exceptionally strong performance during Covid-19. Notably, Kroger reiterated its intention to fight the Federal Trade Commission’s lawsuit to block the Albertsons deal. We continue to believe in Kroger’s long-term prospects.

Major critics

- Communications Charter (CHTR) He was one of the biggest critics during the quarter. In February, the US-headquartered telecommunications services company’s stock price fell when the company announced that the number of broadband subscribers fell 0.2% sequentially. We expect broadband subscriber growth to remain a challenge in the near term due to the intense competitive environment and potential reduction in the government support programme. However, we expect these competitive forces to subside in the medium term and for Charter’s broadband subscriber base to return to normal growth. Meanwhile, the company continues to increase its dividend, invest in high-return capital projects and buy back stock. We maintain our belief in the long-term prospects of Charter Communications.

- Bayer (OTCPK:BAYRY) He was one of the biggest critics during the quarter. In January, the German-headquartered healthcare company received a larger-than-average negative verdict from a jury in its long-running RoundUp lawsuit. We continue to believe that these major rulings will be significantly reduced on appeal and note that Bayer has since won two cases in a row. Then, in March, the company held its long-awaited Capital Markets Day. The event contained limited material strategy updates, with Bayer no longer pre-reporting its litigation strategy, erring conservatively by not issuing medium-term targets, and postponing the spin-off until its balance sheet is in a better position. This hasn’t delivered the quick wins some investors had hoped for, but we support the strategy and appreciate management’s sharp focus on improving profitability and cash generation while beginning to shed corporate bureaucracy. Full-year 2023 results and 2024 guidance were in line with our expectations.

- World Line (OTCPK:WWLNF) It was criticized during the quarter. In February, the French payments company’s share price fell after the publication of its fourth-quarter results. Despite the negative share price reaction, we believe Worldline’s results were generally in line with consensus expectations. Overall, we believe there are two drawbacks to the results. First, Worldline took a €1.15 billion impairment on its business, which we believe is related to Ingenico. Second, guidance was cut significantly from third-quarter results, with management citing macroeconomic weakness and a desire to set guidance they could beat more easily as a rationale. Although we believe we may see some near-term weakness over the next few quarters, we continue to believe in Worldline’s long-term prospects.

Determine the position of the wallet

We initiated the following trades during the period:

- Deere & Company (DE) It is a leading agricultural equipment manufacturer with dominant market shares in North America and Brazil. Despite its strong brand, technology capabilities and distribution advantages, the company’s stock price has recently come under pressure due to investor concerns about the downturn in the current agricultural business cycle. In the long term, global population and food demand are expected to increase annually, with less land and labor devoted to agriculture each year. As a technology leader, we believe Deere is well positioned to capitalize on this dynamic as farms will need to become more productive. We also like that the company’s management team has a proven track record of growing the business organically through cycles, continually improving returns on invested capital and returning capital to shareholders. We were able to purchase shares in the company at a discount to our estimates of intrinsic value and other high-quality industrial companies.

- Reckitt Benckiser Group (OTCPK:RBGPF) It is a global consumer products company with leading brands in consumer health, children’s nutrition, home care and hygiene. We would like more than half of the company’s sales to be generated from consumer health products, a category with high barriers to entry, high margins and attractive growth. Additionally, we believe that improved execution, particularly in sales and supply chain management, coupled with investments in re-accelerating growth, offers the potential for margin expansion in the future. Finally, we appreciate Reckitt Benckiser’s results-oriented culture and management team that has historically created significant value for its shareholders. Trading advantageously off the highs, we have recently been able to purchase shares at a significant discount to our estimate of intrinsic value.

We removed HCA Healthcare (HCA) and Recruit Holdings (OTCPK:RCRRF) from the portfolio during this period.

Prospects

While we monitor the macroeconomic environment, we continue to focus on our bottom-up fundamental analysis at the company level when constructing portfolios. We invest in companies that are priced at significant discounts to our estimates of intrinsic value, which we believe will grow per share value over time, and we have management teams that think and act like owners. Our analysts are industry-agnostic professionals focused on creating value, regardless of what is preferable at any given moment. We believe this positions our portfolios for long-term sustainable success.

|

The securities identified and described in this report do not represent all securities purchased, sold or recommended to advisory clients. There is no guarantee that any securities discussed here will remain in the account’s portfolio at the time it receives this report or that the securities sold will not be repurchased. It should not be assumed that any of the securities, transactions or properties discussed herein have been or will prove profitable. The information, data, analysis, and opinions presented herein (including current investment topics, portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and opinions of the portfolio managers and Harris Associates LP as of the date written and are subject to change without notice. This content is not a recommendation or an offer to buy or sell a security and no guarantee is made of its veracity, completeness or accuracy. Data are in US dollars unless otherwise indicated. Certain comments contained herein are based on current expectations and are considered “forward-looking statements.” These forward-looking statements reflect assumptions and analyzes made by the portfolio managers and Harris Associates LP based on their experience and perception of historical trends, current conditions, expected future developments and other factors they believe to be relevant. Actual future results are subject to a number of investment and other risks and may differ from expectations. Readers are cautioned not to place undue reliance on forward-looking statements. The MSCI World Index (‘Net’) is a market capitalization-weighted and free-float-adjusted index designed to measure global equity market performance in developed markets. The index covers approximately 85% of each country’s free-float-adjusted market capitalization. This standard calculates reinvested earnings net of withholding taxes. This index is unmanaged and investors cannot invest directly in this index. ©2024 Harris Associates LP All rights reserved. |

Original post

Editor’s note: The summary points for this article were selected by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these stocks.