Semiconductors are fairly valued despite high capital intensity challenges (NASDAQ:ON)

J Studios/DigitalVision via Getty Images

This is my first time covering the topic of semiconductors (NASDAQ: ON), and I think it’s a very compelling business to invest in. The company has high levels of earnings growth, which contributes to an exceptional valuation based on my discounted earnings analysis. However, its free cash flow case is less promising, primarily due to much higher levels of capital spending, which makes its intrinsic value look less attractive based on my discounted cash flow model. However, the company’s balance sheet is strong, and growth is high for a company with a low P/E GAAP ratio of 19 at the time of writing. For these reasons, my analyst rating for ON Semiconductor is Buy.

Process analysis

ON Semiconductor, also known as onsemi, is one of the world’s leading semiconductor companies, with operations spanning automotive, industrial and telecommunications. that it invested heavily in Silicon carbide (‘SiC’), which provides higher efficiency and better performance, and is essential for electric vehicle motors and charging infrastructure. In addition, ON is expanding its range Analog and mixed signal platforms to enhance its leadership in energy and sensing technologies; This innovation is important in supporting advanced driver assistance systems (‘ADAS’) and autonomous driving capabilities.

As of December 2023, the Company’s operating segments and geographic areas of operation were as follows:

| Energy Solutions Group (“Paris Saint-Germain”) (53.9% of operating revenues, $4.4 billion) | The Power Solutions Group is ON Semiconductor’s largest segment, focusing on power management products and technologies, primarily for the automotive, industrial and consumer electronics industries. |

| Analog and mixed signals (“AMG”) (30.2% of operating revenues, $2.5 billion) | The Analog and Mixed Signal range includes products that combine analog and digital signals. These technologies are mainly used in signal processing, high-efficiency power management, sensing and control. |

| Smart sensor array (“ISG”) (15.9% of operating revenues, $1.3 billion) | The Intelligent Sensor Group focuses on sensing solutions, including image sensors and other sensing technologies, used primarily in automotive safety, industrial automation, and consumer electronics. |

| Hong Kong | 26.3% of operating revenues, equivalent to $2.2 billion |

| Singapore | 23.5% of operating revenues, equivalent to $1.9 billion |

| United kingdom | 21.2% of operating revenues, equivalent to $1.8 billion |

| United State | 19.1% of operating revenues, equivalent to $1.6 billion |

| last | 9.9% of operating revenues, equivalent to $818.5 million |

I believe ON Semiconductor is very well positioned to capitalize on growing trends in automation and robotics that are likely to intensify significantly over the next few decades. There is no doubt that the global economy is expanding digitally, and I believe that this trend is unlikely to reverse or contract in growth. ON Semiconductor is positioned to continue to be one of the leading companies providing advanced technology solutions. However, there are many competitors in this field:

| Texas Instruments (TXN) | TXN is known for its diverse range of analog and embedded processing products and is a strong competitor to ON in power management and industrial applications. |

| Infineon Technologies (OTCQX:IFNNY) | IFNNY is a leading manufacturer of power semiconductors and automotive electronics. It competes directly with ON in the automotive sector. |

| NXP Semiconductor (Nxby) | NXPI specializes in secure connectivity solutions for embedded applications, and competes with ON in the automotive, industrial and IoT markets. |

| Analog devices (Addy) | ADI focuses on data conversion, signal processing, and power management technologies, and competes in similar areas to ON. |

I will make a detailed financial comparison of these companies in the next section of this article. However, Infineon likely poses the biggest threat to ON Semiconductor given its strong position in the automotive and power semiconductor sectors, where ON also invests heavily. Infineon has extensive investments in silicon carbide, microcontrollers, power semiconductors, sensors and technologies to support ADAS, LiDAR and radar solutions. Additionally, Infineon is a leader in terms of size, with an enterprise value of $56.14 billion at the time of this writing, and ON an enterprise value of $32.02 billion. Texas Instruments also offers a high level of competition, especially in power management and analog signal processing. Texas Instruments’ products are widely used in industrial automation, a key market for ON, and its presence in power management competes directly with ON’s Power Solutions Group.

Financial peer analysis

I mentioned in my introduction that ON has strong earnings growth but much weaker free cash flow growth. For the purposes of peer analysis, please consider the data in the following table:

| on | Texan | IFNNY | Nxby | Addy | |

| EPS Diluted Growth FWD 5Y Average | 22.04% | 5.79% | 25.99% | 13.28% | 9.04% |

| Free cash flow per share growth FWD 5Y average | 27.77% (currently 0.84%) | -1.65% | 34.34% (currently -2.78%) | 5.55% | 16.23% |

| The ratio of equity to assets | 0.6 | 0.49 | 0.59 | 0.38 | 0.72 |

| TTM 5Y Net Income Margin Average | 13.43% (currently 26.67%) | 39.32% | 11.76% (currently 16.47%) | 12.89% | 22.81% |

| project value | $32.02 billion | $181.96 billion | $56.14 billion | $76.59 billion | $119.89 billion |

From this information, we can see that ON is strong in terms of growth. While free cash flow is expected to grow just 0.84% as of the next report, the growth rate has averaged 27.77% over the past five years. Its net income margin is noticeably weaker than Texas Instruments (which has much less favorable growth) but stronger than Infineon’s. Among the five peer companies, I consider Infineon to be the strongest company by far on an operational and financial basis at the time of this writing.

The main reason ON’s free cash flow growth is lower at the moment is because it is making more capital expenditures. Based on TTM data, ON has net capital expenditures of -$1,474.1 million and revenues of $8,156 million, which translates to a capital intensity of 18.1%. Expenditures are likely to be primarily directed toward expanding and modernizing the company’s manufacturing capabilities, particularly for silicon carbide technology and advanced packaging solutions. These investments are essential to support the growing demand for electric vehicles, driver assistance systems, and other advanced automotive technologies. Infineon has also made similar capital expenditures recently, with major investments in a Malaysian manufacturing unit to support electric vehicles and renewable energy systems, a German manufacturing unit for analog/mixed signal components and power semiconductors, and machines to manufacture silicon carbide and gallium nitride. products. Infineon’s capital intensity currently, based on TTM data, is 17.6%. This shows a critical comparison between the two companies, where competition is fierce, and I believe Infineon takes the lead, with higher growth rates, greater enterprise value, and equal capital intensity, leading to what I expect will be a permanent market leadership for Infineon.

Evaluation analysis

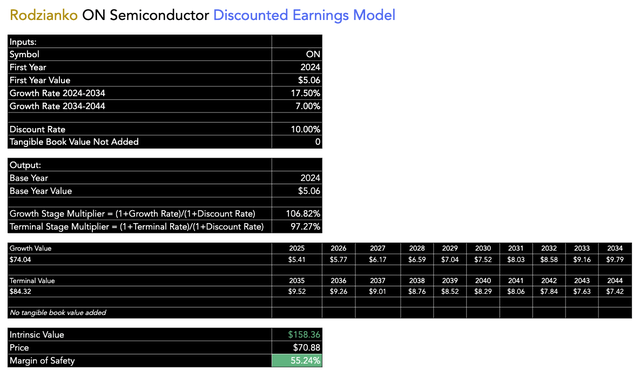

I mentioned that ON performs very well in the diluted earnings analysis. Therefore, I begin my assessment of the evaluation with the following model:

Author model

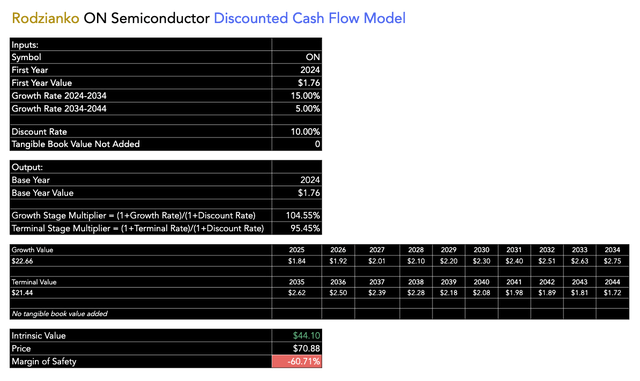

The above inputs for growth rates are conservatively optimistic, considering the historical growth rate over the past five years averages diluted earnings per share (“FWD”) of 22.04%. I used a discount rate of 10%, as I consider this to be the average annual return for the market. The resulting margin of safety of over 50% is very promising as an investment case. However, if you design it based on discounted cash flows rather than earnings, the overall outlook is less positive. It is difficult to assess ON’s intrinsic value based on free cash flow because free cash flow has not been stable, making the DCF model’s initial value somewhat unreliable if you start with TTM free cash flow per share. So, for my model, I used the five-year average of starting free cash flow per share:

Author model

The result shows a significant overvaluation of the currency, which I believe investors should carefully consider. While this does not significantly detract from the overall investment thesis here, the high levels of capital intensity required to remain competitive have a negative impact on free cash flow, leaving less space and security in a company’s financial statements.

However, even in light of this assessment of intrinsic value, the stock is likely to be fairly undervalued, in my opinion, when evaluated on the GAAP forward P/E ratio versus peers that I used in my financial analysis and analysis above:

| Forward P/E ratio according to GAAP | |

| on | 18.82 |

| Texan | 38.15 |

| IFNNY | 24.93 |

| Nxby | 24.20 |

| Addy | 71.43 |

ON Semiconductor is the cheapest of its five peers when analyzed this way. Therefore, I think the stock price is fair, even taking into account the discounted earnings and variance in the discounted cash flow analysis I provided above. It is common for semiconductor companies to perform poorly in discounted cash flow models, but this does not change the overall market sentiment towards the companies; I think they are more commonly valued based on earnings than free cash flow when ascertaining fair value.

Risk analysis

ON Semiconductor operates in a capital-intensive industry, which could result in cash flow stress. This can make it difficult for a company to remain competitive during times when it may need to take on more debt, for example, during supply chain disruptions or shortages and geopolitical unrest. They may sometimes have to sacrifice their operating capabilities for the sake of their financial debt, as an example of how high capital intensity can work against their long-term prosperity.

In addition, the semiconductor industry is characterized by rapid technological changes, which include potential threats from innovations coming from competing companies. If ON is slow to adapt to changes or is not a leader in its offerings, this will negatively impact its position in the market. This risk area is heightened because the market is saturated with competition, and larger competitors like Infineon and Texas Instruments may have the financial weight to undertake more serious innovations over time.

Main elements

ON Semiconductor is a leading silicon carbide company and a pioneer in analog and mixed signal platforms, which is important in supporting autonomous driving capabilities. ON’s main competitors include Infineon and Texas Instruments, of which I consider Infineon the best investment.

ON has competitive growth compared to Texas Instruments, but is slightly worse than Infineon in this regard. The semiconductor industry is capital intensive, which means there are periods of weakness in free cash flow. Infineon has equal capital intensity but higher growth rates and greater enterprise value.

ON is cheap compared to peers based on GAAP price-to-earnings ratios, and shows strength in my 20-year discounted earnings model. However, the DCF model makes the valuation look less promising due to the capital intensity I mentioned. This opens up risks in how cash flow is managed during macroeconomic challenges, increasing the complexity of maintaining competitiveness over long time frames.

Conclusion

ON Semiconductor seems like a compelling investment to me. Despite having larger competitors, ON Semiconductor will likely remain one of the leaders in semiconductor solutions moving forward. I think its valuation is attractive, even when acknowledging the weakness revealed by the company’s DCF analysis. The company has historically delivered strong earnings growth rates, which translates well to my discounted earnings model expectations. My overall feeling about the company is positive. I estimate that it is very valuable given my peer analysis and is worth the investment.