Simmons First National: Attractively Valued but Dividends Likely to Drop (NASDAQ:SFNC)

Designer491

Simons First National Company’s profits (Nasdaq: SFNC) is likely to be lower this year compared to last year due to the lower average margin. On the other hand, branch additions and local economic conditions will drive loan growth, which in turn will support earnings. In general, I expect Simmons First National reports earnings of $1.31 per share for 2024, down 4.8% year over year. Compared to my country final report As for the company, I’ve lowered my earnings estimate and I’ve lowered my margin estimate for the year. The year-end target price indicates a moderate upside from the current market price. Moreover, the company offers a good dividend yield. Based on the expected total return, I maintain a Buy rating on Simmons First National shares.

Fringe on a gentle slope

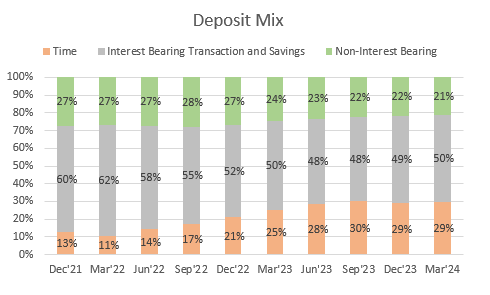

After a sharp decline in the first nine months of 2023, the net interest margin fell It has become more limited in scope over the last two quarters. Moreover, after deteriorating significantly over the past two years, the deposit mix appears to have stabilized over the past two or three quarters.

SEC files

I expect the deposit mix to remain stable for the rest of the year because stable and declining interest rate environments discourage deposit migration. It is only the high interest rate environment that encourages depositors to move their money towards accounts with high interest rates.

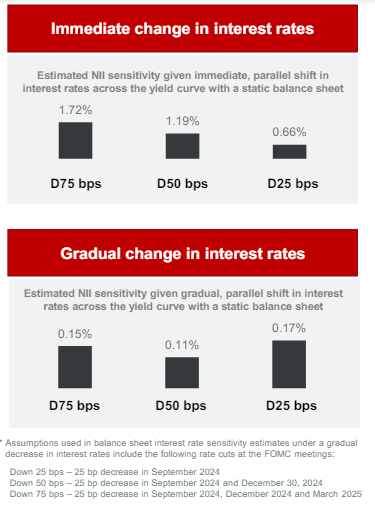

I expect interest rate cuts of 25-50 basis points in the remainder of the year, which will have a slight positive impact on margin. Variable-rate loans make up 47% of total loans, and will reprice shortly after each rate cut, according to details in the earnings presentation. Meanwhile, about 26% of interest-bearing deposits are tied to index rates, primarily the Fed funds target rate. Although more assets than liabilities will be repriced in the immediate aftermath of the interest rate cut, management appears to believe that the total repricing of liabilities will outweigh the repricing of assets. The results of management’s interest rate sensitivity analysis show that a 75 basis point interest rate cut could increase net interest income by 0.15%.

First quarter 2024 earnings presentation

Given these factors, I expect margin to increase by 2 basis points in each of the last three quarters of 2024. Since the recovery will be less severe than last year’s decline, the 2024 average margin will likely be lower than the average margin. For 2024. Average margin for 2023. Overall, I expect margin to average 2.67% this year, down 11 basis points from last year.

Compared to my last report on the company, I revised my 2024 average margin estimate downward because the actual margin reported in the last two quarters was different from my expectations.

Branch additions and strong business markets to support loan growth

Loan growth improved in the first quarter of 2024 after showing lackluster performance in the second half of 2023. The portfolio grew 0.9% during the first quarter, in line with my previous forecast in my last report on the company.

Simmons First National has been very active in adding branches recently, which should support loan growth in the near term. According to press releases, the company added a branch in Dallas, Texas, and another in St. Louis, Missouri during the fourth quarter of 2023. Additionally, the company opened a new branch in Pine Bluff, Arkansas, another in Dallas, Texas, and another in Brentwood, Tennessee. During the first quarter of the year. So far this quarter, Simmons has opened a new center in Memphis, Tennessee.

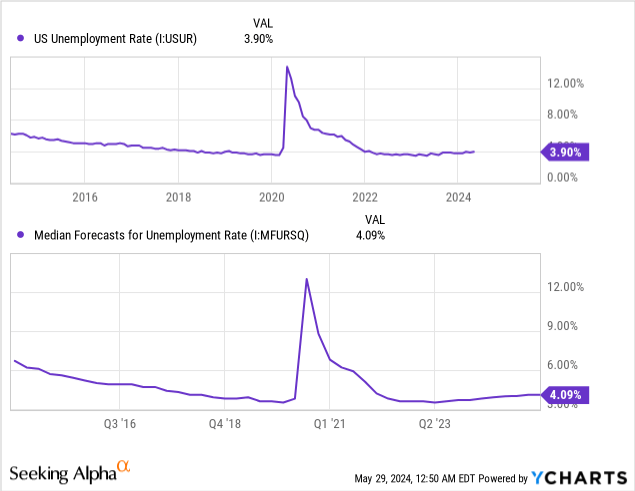

Moreover, the macroeconomics currently appear to be favorable for loan growth. Simmons First National operates in Arkansas, Kansas, Missouri, Oklahoma, Tennessee and Texas. Since the company’s markets are quite diverse, I think it is appropriate to take the national average as a proxy for different markets. As shown below, the unemployment rate remains at a very low level. Moreover, according to a survey of professional forecasters, the unemployment rate is expected to rise this year, but will remain below the 2018 level.

Given these factors, I expect the loan portfolio to grow by 1% in each of the last three quarters of 2024. Furthermore, I expect deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Center | Fiscal year 2019 | FY20 | FY21 | FY22 | FY23 | Fiscal year 24 AH |

| net loans | 14,357 | 12,663 | 11,807 | 15,946 | 16,620 | 17,283 |

| Net loan growth | 23.1% | (11.8)% | (6.8)% | 35.1% | 4.2% | 4.0% |

| Other earning assets | 4,537 | 7200 | 10,123 | 8,098 | 7,157 | 7,075 |

| Deposits | 19,850 | 16,987 | 19,367 | 22,548 | 22,245 | 23,030 |

| Subsidiary loans and debts | 1,836 | 2,024 | 1,908 | 1,386 | 1,406 | 1,316 |

| Common stock | 2,988 | 2,976 | 3,249 | 3,269 | 3,426 | 3,486 |

| Book value per share ($) | 30.2 | 27.0 | 28.4 | 26.3 | 27.0 | 27.7 |

| Tangible BVPS ($) | 18.3 | 16.2 | 17.4 | 14.6 | 15.7 | 16.4 |

| Source: Securities and Exchange Commission filings, earnings releases, and author estimates (in $million unless otherwise stated) | ||||||

Profits are likely to decrease due to margin

2024 earnings will likely be lower than 2023 earnings because this year’s average margin will likely be lower than last year’s average margin. On the other hand, loan growth is likely to support earnings. In addition, I make the following assumptions for the project’s profits for the year.

- I expect the provisions-to-loans ratio to remain steady at its average over the last three quarters.

- I expect non-interest income to remain unchanged from the first quarter level.

- Simmons First National’s management has taken steps to trim its operating expenses, including cutting its headcount by more than 6% compared to last year, as noted in the earnings presentation. As a result, I am optimistic that non-interest expenses will remain within range for the rest of the year.

Overall, I expect Simmons First National to report earnings of $1.31 per share for 2024, down 4.8% year over year. The following table shows my income statement estimates.

| Income statements | Fiscal year 2019 | FY20 | FY21 | FY22 | FY23 | Fiscal year 24 AH |

| Net interest income | 602 | 640 | 592 | 717 | 650 | 619 |

| Loan loss provisions | 43 | 75 | (33) | 14 | 42 | 34 |

| Income other than interest | 198 | 240 | 192 | 170 | 156 | 174 |

| Non-interest expenses | 454 | 485 | 484 | 567 | 563 | 564 |

| Net Income – Shared. | 238 | 255 | 271 | 256 | 175 | 165 |

| Earnings per share – diluted ($) | 2.41 | 2.31 | 2.46 | 2.06 | 1.38 | 1.31 |

| Source: Securities and Exchange Commission filings, earnings releases, and author estimates (in $million unless otherwise stated) | ||||||

In my last report, I forecast earnings of $1.52 per share for 2024. I revised my earnings estimates mostly downward because I lowered my margin estimate for the year after reporting actual margin for both Q4 2023 and Q1 2023. Turns out That the 2024 quarter will be different from my expectations.

The risks appear low

Taking a quick look at Simmons First National’s reports, I found no source of risk that would be a cause for concern. The credit quality of the loan portfolio appears satisfactory, as non-performing loans constitute 0.63% of total loans. Furthermore, office loans totaled $892 million at the end of March, representing 5% of total loans, which is substantial but not a problem in my opinion.

The liability side of the balance sheet also appears to be low risk. About 20% of deposits are uninsured or unsecured, according to details in the earnings presentation. These deposits are comfortably covered by available liquidity, which is 2.5 times the level of unsecured and uncollateralized deposits.

SFNC offers a 4.9% dividend yield

Simmons First National currently pays a quarterly dividend of $0.21 per share, which implies a healthy dividend yield of 4.9% using the May 28 closing price. The dividend seems safe to me because my earnings and earnings estimates indicate a payout ratio of 63.9%, which is reasonable. However, this return is much higher than the past five-year average of 36%.

SFNC’s capital level is more than adequate, which is another reason why I think the dividend is safe. The company reported a total capital ratio of 14.43% at the end of March 2024 (as reported in its 10-Q filing), which is well above the minimum regulatory requirement of 10.50%.

Maintain Buy rating

I find it interesting that Simmons First National allowed $175 million worth of stock buybacks in January 2024, but did not make any buybacks during the first quarter, according to disclosures made in the earnings presentation. The average market price of SFNC was $18.9 during the first quarter. It seems to me that management did not think that this price was attractive enough to buy the shares.

However, my evaluation analysis leads to a different result, as shown below.

I use historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Simmons First National Corporation. The stock has traded at an average P/TB ratio of 1.41 in the past, as shown below.

| Fiscal year 2019 | FY20 | FY21 | FY22 | FY23 | middle | |

| T. Book value per share ($) | 18.3 | 16.2 | 17.4 | 14.6 | 15.7 | |

| Average market price ($) | 24.9 | 18.9 | 29.2 | 24.7 | 18.2 | |

| Historical price of TB/TB | 1.36x | 1.16x | 1.67x | 1.69x | 1.16x | 1.41x |

| Source: Company financial statements, Yahoo Finance, author’s estimates | ||||||

Multiplying the average price-to-TB multiple with the expected tangible book value per share of $16.4, we get a price target of $23.1 for the end of 2024. This price target implies an upside of 34.0% from the closing price on May 28. The following table shows the sensitivity of the target price to the P/E ratio.

| Multi-P/TB | 1.21x | 1.31x | 1.41x | 1.51x | 1.61x |

| TBVPS – December 2024 ($) | 16.4 | 16.4 | 16.4 | 16.4 | 16.4 |

| Target price ($) | 19.8 | 21.4 | 23.1 | 24.7 | 26.3 |

| Market price ($) | 17.2 | 17.2 | 17.2 | 17.2 | 17.2 |

| Upside/(Downside) | 15.0% | 24.5% | 34.0% | 43.5% | 53.0% |

| Source: Author’s estimates |

The stock has traded at an average P/E ratio of about 11.1 times in the past, as shown below.

| Fiscal year 2019 | FY20 | FY21 | FY22 | FY23 | middle | |

| Earnings per share ($) | 2.41 | 2.31 | 2.46 | 2.06 | 1.38 | |

| Average market price ($) | 24.9 | 18.9 | 29.2 | 24.7 | 18.2 | |

| Historical PE multiple | 10.3x | 8.2x | 11.9x | 12.0x | 13.2x | 11.1x |

| Source: Company financial statements, Yahoo Finance, author’s estimates | ||||||

Multiplying the average P/E multiple with expected earnings per share of $1.31 gives a price target of $14.6 for the end of 2024. This target price implies a 15.2% downside from the closing price on May 28. The following table shows the sensitivity of the target price to the P/E ratio.

| Multiple P/E | 9.1x | 10.1x | 11.1x | 12.1x | 13.1x |

| Earnings per share 2024 ($) | 1.31 | 1.31 | 1.31 | 1.31 | 1.31 |

| Target price ($) | 12.0 | 13.3 | 14.6 | 15.9 | 17.2 |

| Market price ($) | 17.2 | 17.2 | 17.2 | 17.2 | 17.2 |

| Upside/(Downside) | (30.5)% | (22.8)% | (15.2)% | (7.6)% | 0.1% |

| Source: Author’s estimates |

Equal weighting of the target prices from the two evaluation methods gives a combined result Target price is $18.8Which means an increase of 9.4% from the current market price. Adding the forward dividend yield gives a total expected return of 14.3%.

In my last report, I adopted a Buy rating with a price target of $18.60. Even though I lowered my earnings estimate, my price target is higher now because the historical multiples are higher. Based on the updated expected total return, I maintain a Buy rating on Simmons First National Corporation.