The role of safe haven currencies

Sisiriadigar

Written by Bob Iaccino

In a glance

- Investors tend to look for countries that are economically and financially stable when considering a currency’s safe haven status

- The US dollar, Swiss franc, and Japanese yen are among the most popular safe haven currencies

Safe haven currencies can be an important component of global investors’ toolkit, especially during periods of high market volatility or geopolitical uncertainty. They are often used by investors to mitigate risk and preserve capital during periods of “risk off,” when there is less appetite for investments that typically carry more risk.

Understanding the role of these currencies, the reasons they are considered safe havens, and their behavior during turbulent times is crucial to managing investment risk effectively.

Investors expect a safe-haven currency to maintain or increase its value during times of market turmoil, making it a desirable option for those who are risk averse. The main characteristics of a safe haven currency include:

Political stability: Countries with stable political systems are less vulnerable to economic fluctuations, making their currencies more attractive during turbulent times.

Economic power: Large, resilient and diversified economies can better withstand global economic shocks, supporting the strength of their currencies.

Financial depth: The currencies of countries with deep and liquid financial markets tend to be favored as safe havens because they allow investors to enter and exit large positions without significantly affecting the value of the currency.

Low inflation rate: A relatively stable and low inflation environment contributes to the currency’s purchasing power, enhancing its appeal as a safe haven.

Traditional safe haven currencies

US Dollar (USD): The US dollar is the global reserve currency held by most banks and central institutions as part of their foreign exchange reserves. The dominant economic position of the United States and the widespread use of its currency in global trade make the US dollar the safe haven of choice.

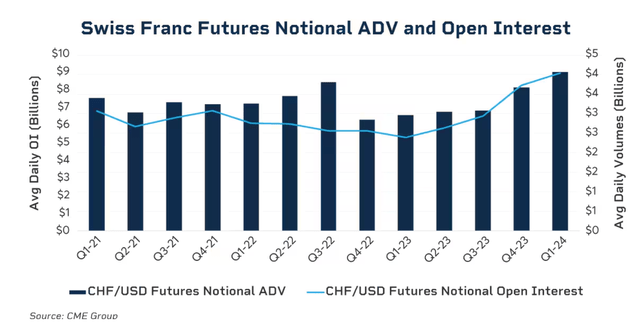

Swiss Franc (Swiss Franc): Switzerland’s long-standing policy of political neutrality and fiscal prudence contribute to its status as a safe haven. Moreover, the Swiss National Bank’s commitment to maintaining currency stability attracts safe haven investments.

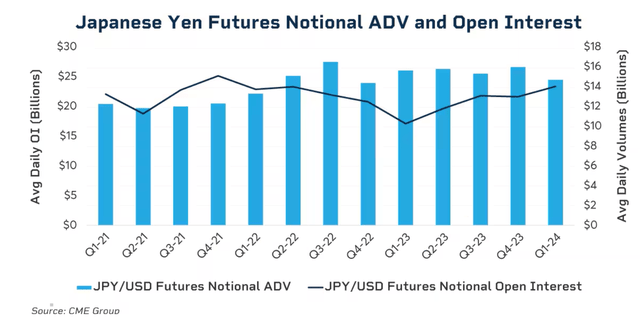

Japanese Yen (JPY): Japan’s large economy and liquidity of financial markets make it a safe haven despite high levels of public debt. Some may argue against the idea that Japan has strong economic fundamentals, but the yen benefits from Japan’s current account surplus, which provides support during economic downturns.

Balanced portfolio

During periods of high uncertainty, such as financial crises, geopolitical conflicts or economic downturns, investors tend to shift assets towards safe-haven currencies. This shift is driven by a strategy to reduce exposure to potential losses in investments that can carry more risk, such as stocks or emerging market currencies.

By including safe haven currencies in a portfolio, investors can diversify their holdings, thus spreading risk and potentially reducing the overall volatility of the portfolio. Investors who hold assets in high-risk currencies can buy safe haven currencies to hedge against potential losses. This strategy is preferred by multinational companies and global investors who need to manage currency exposure across different markets.

The primary goal of many investors in times of crisis is to preserve capital. Thanks to their stability and reliability, safe haven currencies can provide a shelter for capital, and perhaps even maintain their value when other assets decline.

Demand for safe haven currencies usually increases during periods of risk off, causing their value to rise against other currencies. When investors seek liquidity and safety, simultaneous selling of riskier assets and currencies can lead to this rally.

However, the role of safe haven currencies is not static and can be affected by global economic conditions and central bank policies. For example, central bank intervention through quantitative easing, currency purchases, or changes in interest rates can affect the safety and attractiveness of a currency. By understanding the characteristics that make these currencies safe havens and how they can be used in risk management strategies, investors can better navigate through periods of uncertainty and volatility in global markets.

Original post

Editor’s note: The summary points for this article were selected by Seeking Alpha editors.